Question:

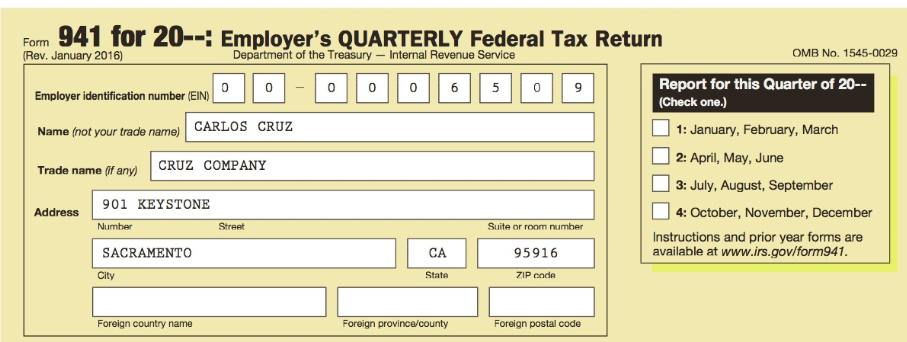

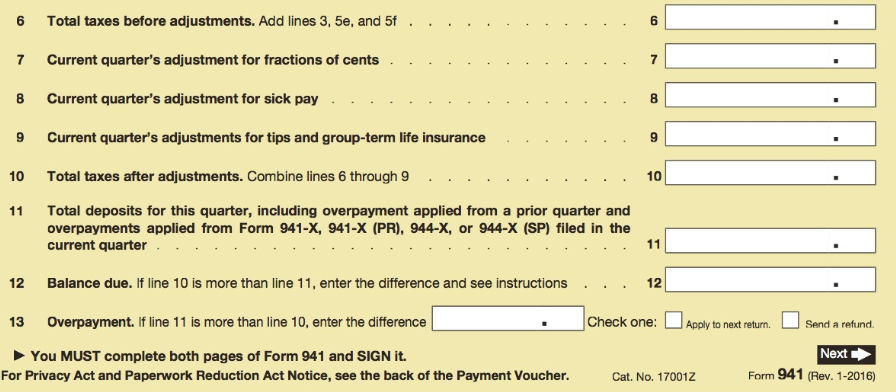

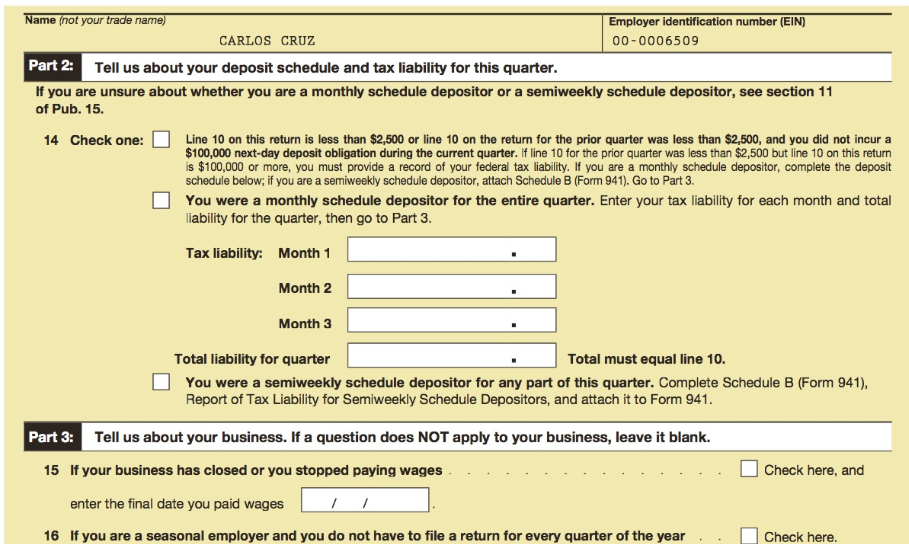

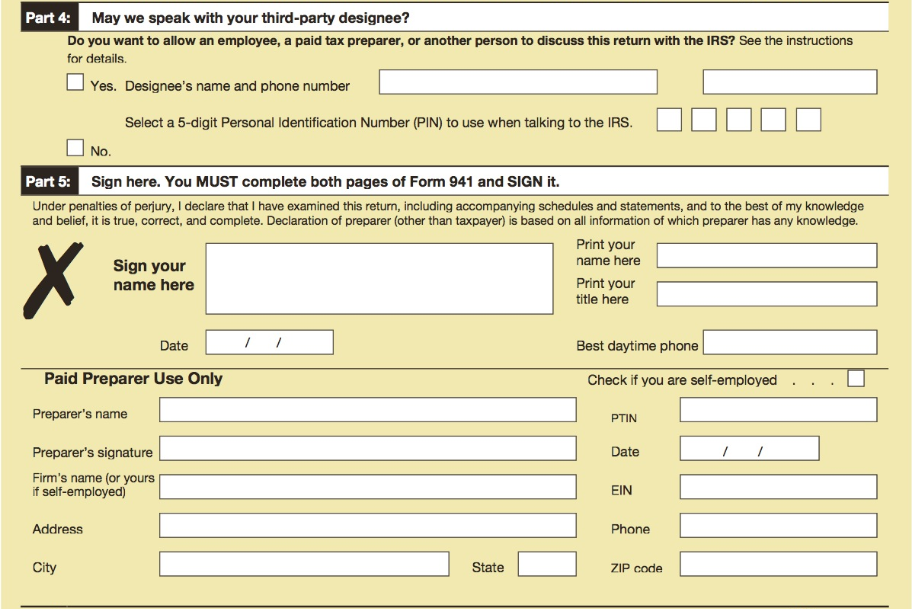

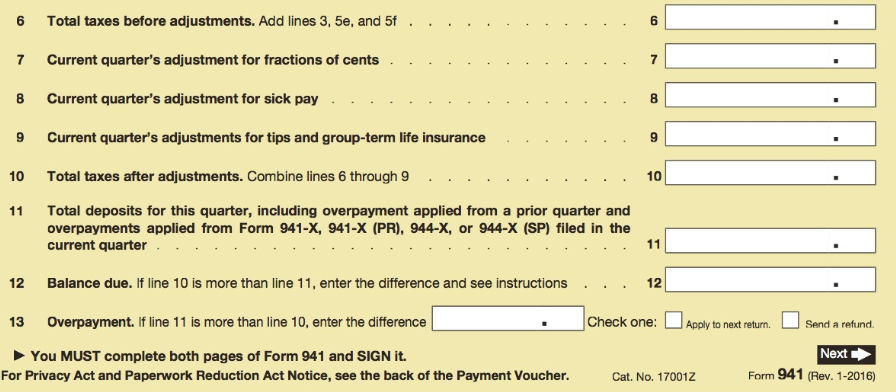

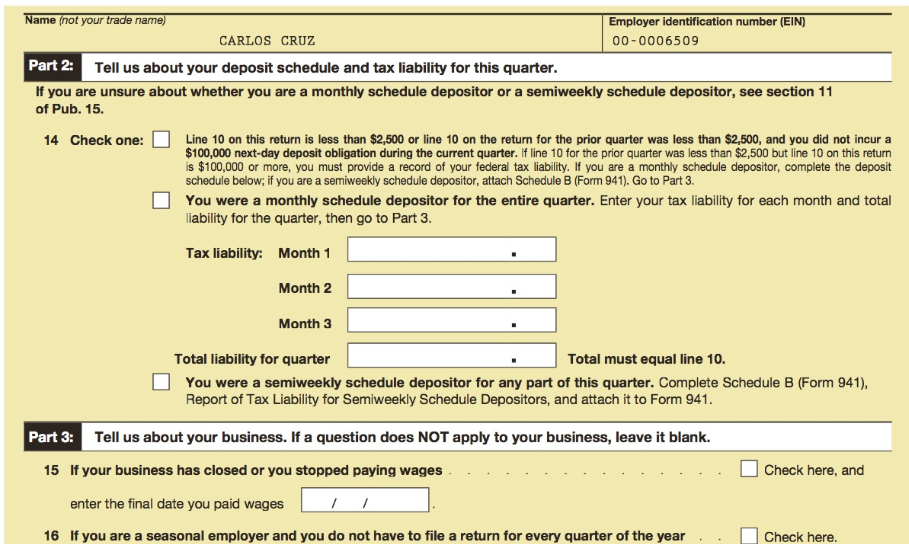

Refer to Problem 3-11A. Complete Parts 2, 4, and 5 of Form 941 (on page 3-41) for Cruz Company for the third quarter of 2017. Cruz Company is a monthly depositor with the following monthly tax liabilities for this quarter:

July .........................$7,193.10

August .......................7,000.95

September.................7,577.78

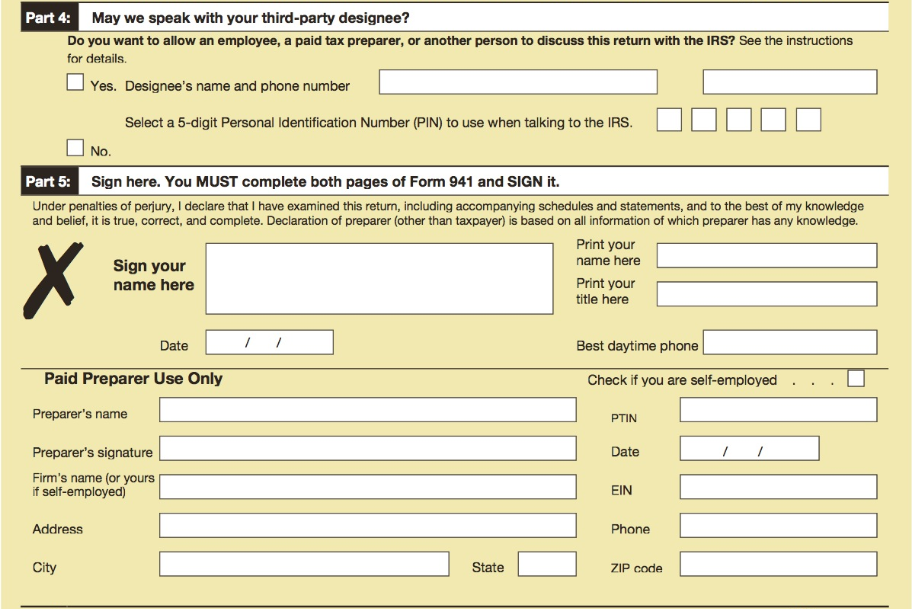

State unemployment taxes are only paid to California. The company does not use a third-party designee and the tax returns are signed by the president, Carlos Cruz (Phone: 916-555-9739).

Refer problem 3-11A

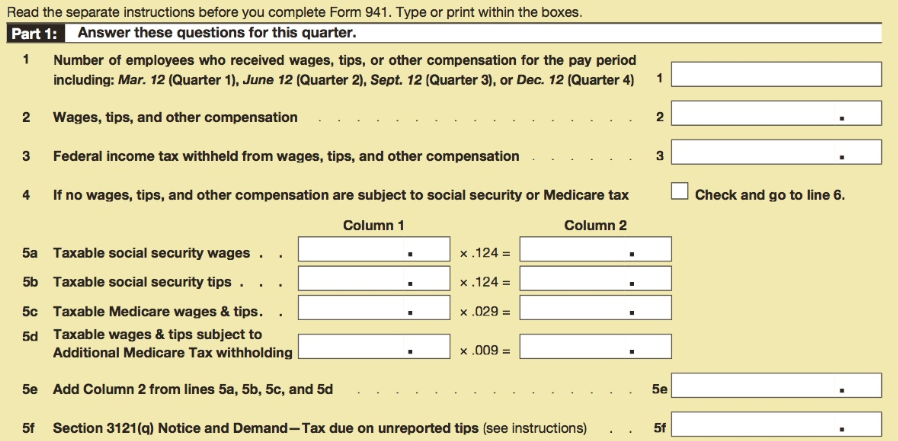

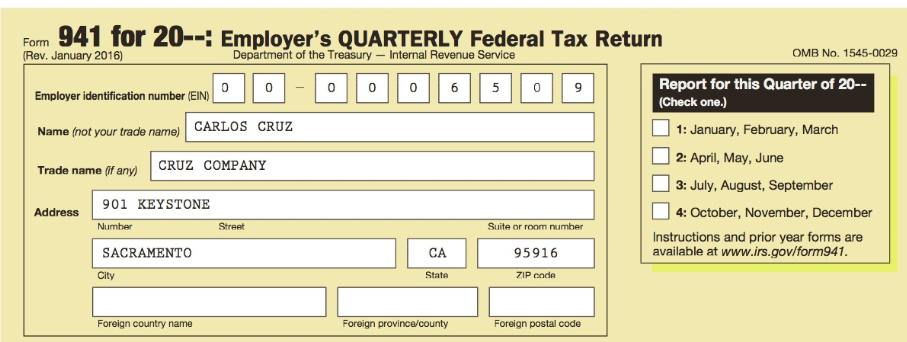

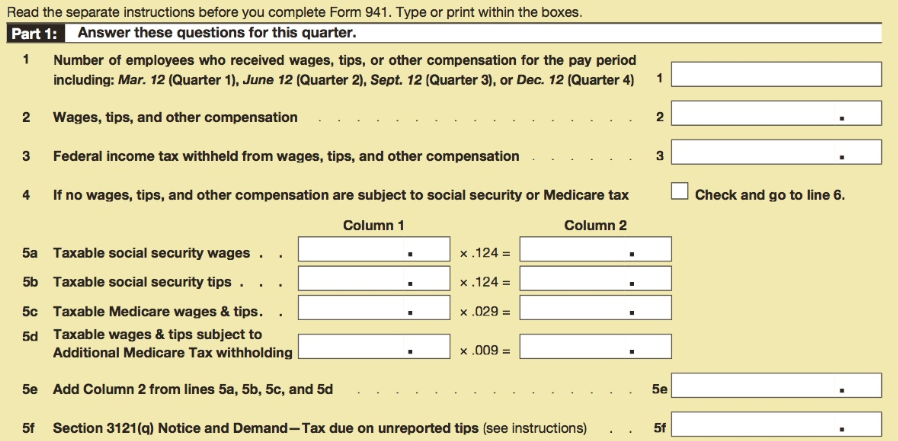

Cruz Company has gathered the information needed to complete its Form 941 for the quarter ended September 30, 2017. Using the information presented below, complete Part 1 of Form 941,

Transcribed Image Text:

Form 941 for 20--: Employer's QUARTERLY Federal Tax Return OMB No. 1545-0029 Department of the Treasury – Internal Revenue (Rev. January 2016) Service Report for this Quarter of 20-- Employer identification number (EIN) 5 6 (Check one.) 1: January, February, March 2: April, May, June CARLOS CRUZ Name (not your trade name) Trade name (if any) CRUZ COMPANY 3: July, August, September 4: October, November, December Instructions and prior year forms are available at www.irs.gov/form941. 901 KEYSTONE Address Number Suite or room Street number SACRAMENTO CA State 95916 ZIP code City Foreign province/county Foreign postal code Foreign country name Read the separate instructions before you complete Form 941. Type or print within the boxes. Part 1: Answer these questions for this quarter. Number of employees who received wages, tips, or other compensation for the pay period including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 2 Wages, tips, and other compensation 3 Federal income tax withheld from wages, tips, and other compensation 4 If no wages, tips, and other compensation are subject to social security or Medicare tax Check and go to line 6. Column 1 Column 2 5a Taxable social security wages x .124 = 5b Taxable social security tips . x.124 = 5c Taxable Medicare wages & tips. x .029 = 5d Taxable wages & tips subject to Additional Medicare Tax withholding x .009 = 5e Add Column 2 from lines 5a, 5b, 5c, and 5d 5e 5f Section 3121(q) Notice and Demand-Tax due on unreported tips (see instructions) 5f