Question:

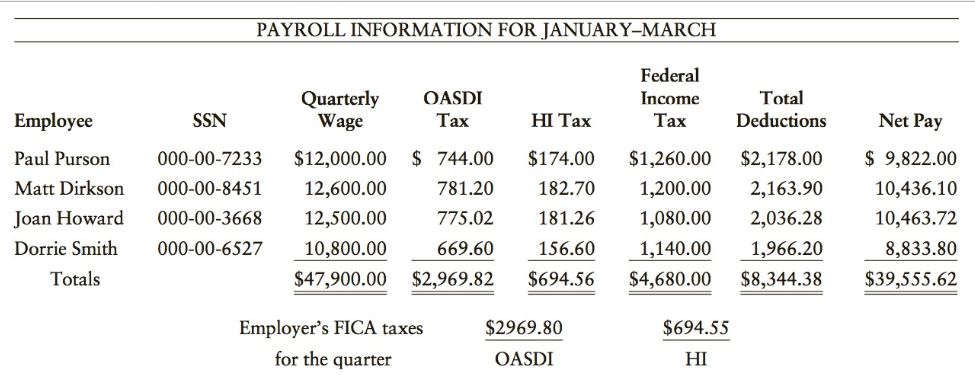

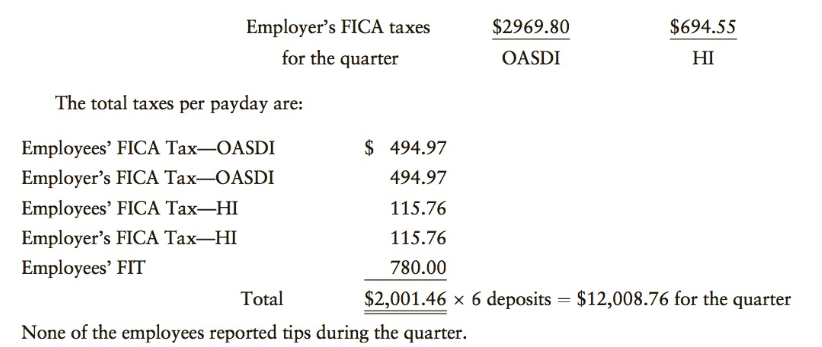

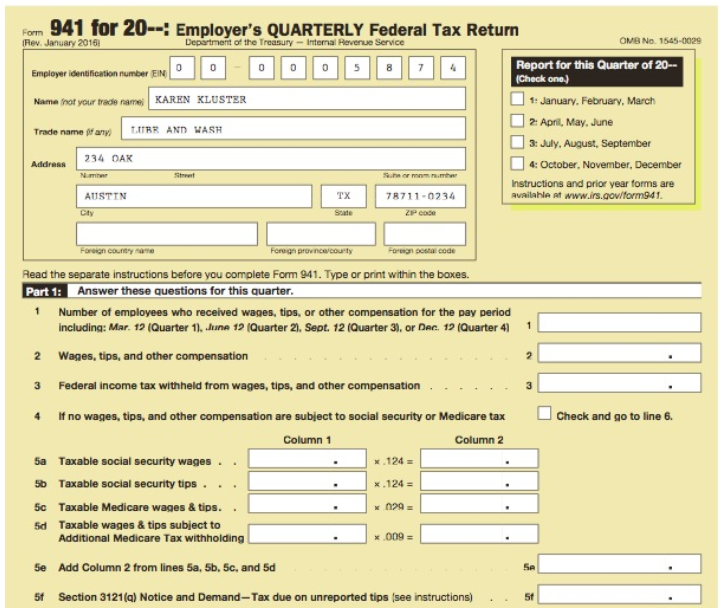

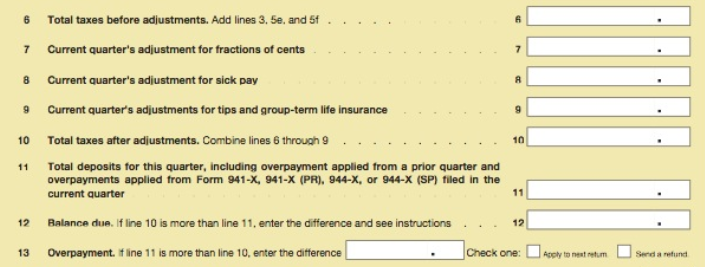

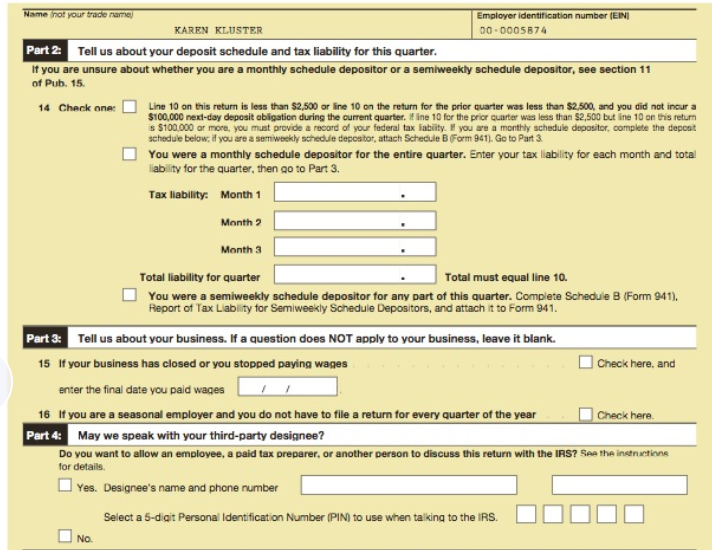

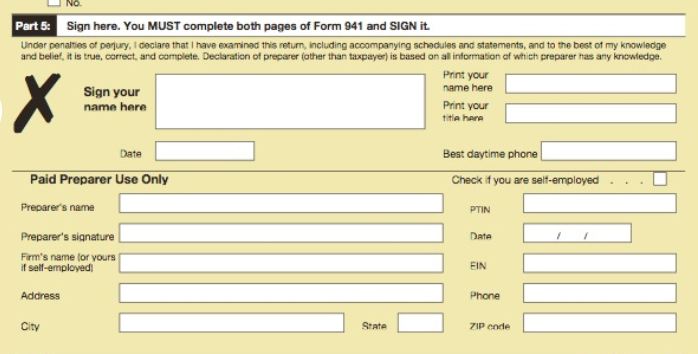

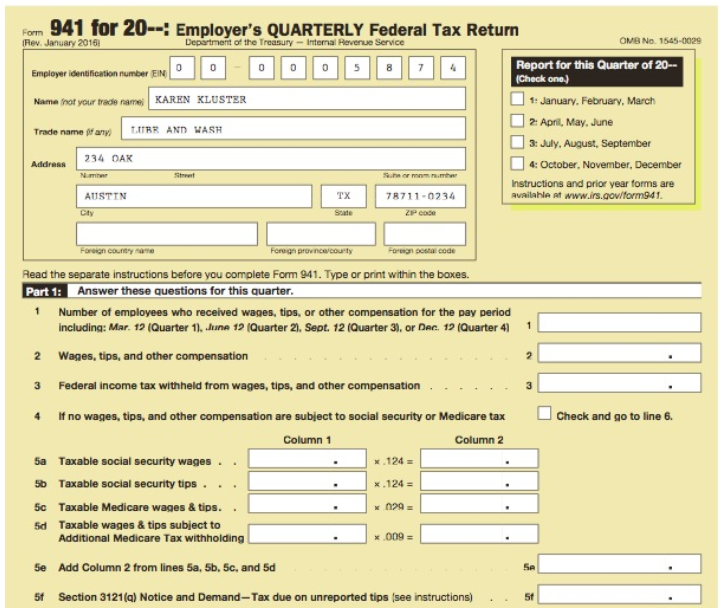

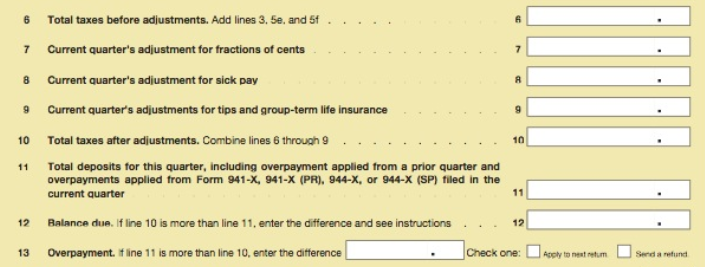

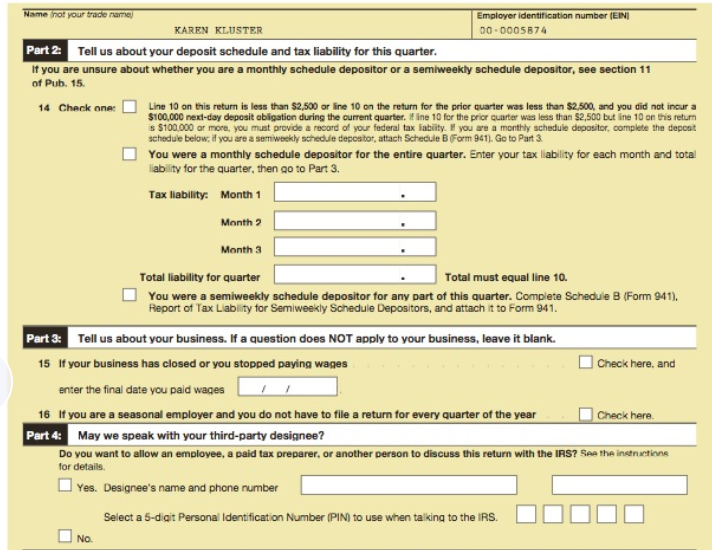

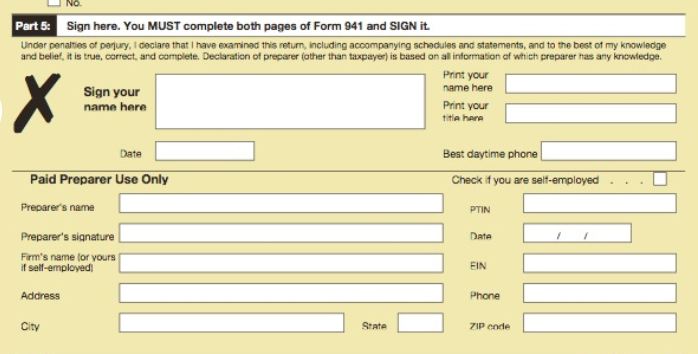

Karen Kluster opened Lube and Wash on January 3, 2017. The business is subject to FICA taxes. At the end of the first quarter of 2017, Kluster, as president of the company, must file Form 941, Employer€™s Quarterly Federal Tax Return. Using Form 941(Parts 1 through 5), reproduced on pages 3-43 and 3-44, prepare, sign, and date the return on the basis of the information shown below.

Employer€™s address: 234 Oak, Austin, TX 78711-0234

Employer€™s ID number: 00-0005874

Phone number: (512) 555€“1111

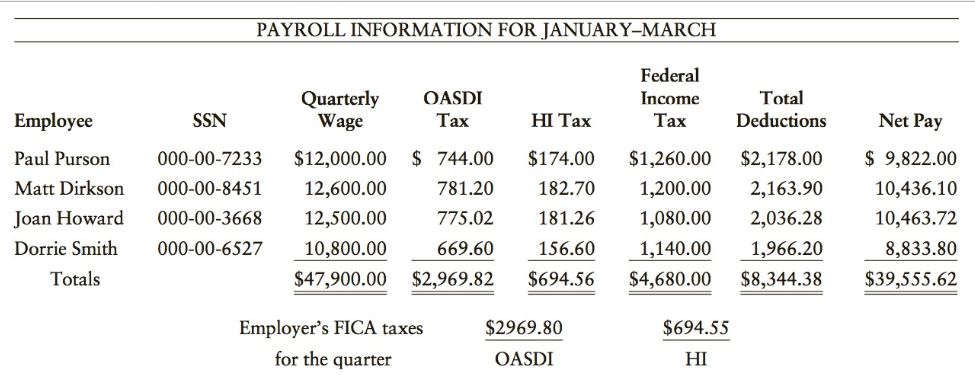

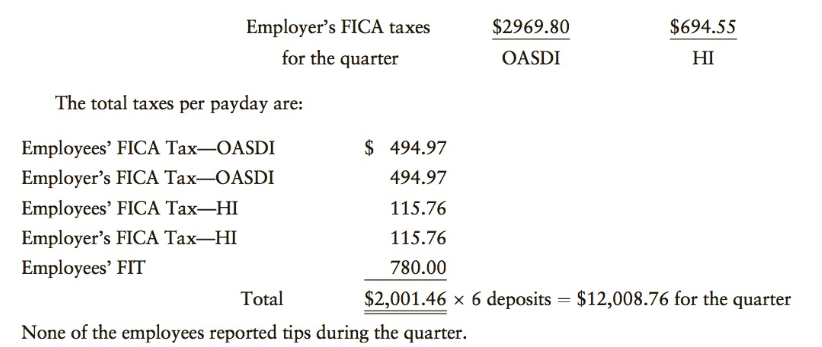

Each employee is paid semimonthly on the 15th and last day of each month. Shown below is the payroll information for the first quarter of 2017. All pay periods were the same.

Transcribed Image Text:

PAYROLL INFORMATION FOR JANUARY-MARCH Federal Income OASDI Total Deductions Quarterly Wage Net Pay Employee Tax SSN НI Таx Tax $ 744.00 $ 9,822.00 Paul Purson $12,000.00 $174.00 182.70 $1,260.00 $2,178.00 000-00-7233 Matt Dirkson 10,436.10 000-00-8451 12,600.00 781.20 1,200.00 2,163.90 181.26 000-00-3668 775.02 Joan Howard 10,463.72 8,833.80 1,080.00 12,500.00 2,036.28 669.60 Dorrie Smith Totals 10,800.00 $47,900.00 $2,969.82 1,966.20 $8,344.38 000-00-6527 156.60 1,140.00 $39,555.62 $694.56 $4,680.00 Employer's FICA taxes for the quarter $2969.80 $694.55 НI OASDI Employer's FICA taxes $2969.80 $694.55 for the quarter OASDI HI The total taxes per payday are: Employees' FICA Tax-OASDI $ 494.97 Employer's FICA Tax-OASDI 494.97 Employees' FICA Tax-HI 115.76 Employer's FICA Tax–HI Employees' FIT 115.76 780.00 Total $2,001.46 × 6 deposits = $12,008.76 for the quarter None of the employees reported tips during the quarter.