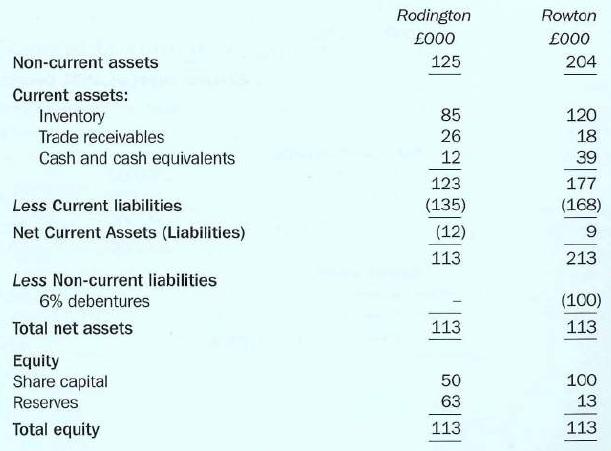

The balance sheets of Rodington Ltd and Rowton Ltd at 31 May 2009 were as follows: Notes:

Question:

The balance sheets of Rodington Ltd and Rowton Ltd at 31 May 2009 were as follows:

Notes:

1 The profits of Rodington Limited are expected to continue at £40,000 p.a. The profits of Rowton Limited have averaged £40,000 before debenture interest.

2 Balance sheets at 31 May 2008 for both companies showed broadly similar figures to those for 2009.

a From the balance sheets as at 31 May 2009, calculate the following ratios for both companies, and give a brief explanation of their significance:

(ii) Gearing ratio (ii) Current ratio (iii) Acid test ratio (iv) Return on capital employed.

b Assume that you had been asked for advice by a cautious potential investor who has £20,000 available. Explain which of the two companies appears to represent the better choice of investment on the basis of the evidence provided.

c If the audit report on Rodington 's accounts had stated that the business was not a going concern, how would that affect your views on the company, and in particular the advice given to the potential investor in

(b) above?

Step by Step Answer: