Presented below is information for Sarah Waters, a sole trader, for the year ended 31 December 2020.

Question:

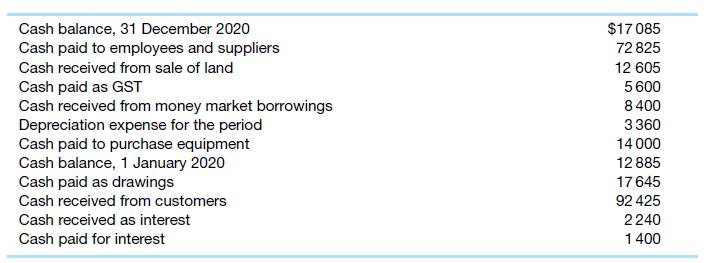

Presented below is information for Sarah Waters, a sole trader, for the year ended 31 December 2020. Use the information to prepare a statement of cash flows.

Transcribed Image Text:

Cash balance, 31 December 2020 Cash paid to employees and suppliers Cash received from sale of land Cash paid as GST Cash received from money market borrowings Depreciation expense for the period Cash paid to purchase equipment Cash balance, 1 January 2020 Cash paid as drawings Cash received from customers Cash received as interest Cash paid for interest $17085 72 825 12 605 5600 8400 3360 14 000 12 885 17 645 92 425 2240 1 400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (12 reviews)

SARAH WATERS Statement of cash flows For the year ended 31 December 2020 Cash fr...View the full answer

Answered By

John Kimutai

I seek to use my competencies gained through on the job experience and skills learned in training to carry out tasks to the satisfaction of users. I have a keen interest in always delivering excellent work

4.70+

11+ Reviews

24+ Question Solved

Related Book For

Accounting Business Reporting For Decision Making

ISBN: 9780730369325

7th Edition

Authors: Jacqueline Birt, Keryn Chalmers, Suzanne Maloney, Albie Brooks, Judy Oliver, David Bond

Question Posted:

Students also viewed these Business questions

-

To prepare its statement of cash flows for the year ended December 31, 2010, Sweet Confections, Inc., gathered the following information: Gain on sale of land .............. $ 25,000 Proceeds from...

-

To prepare its statement of cash flows for the year ended June 30, 2011, Glavine Sports Products, Inc., gathered the following information: Loss on sale of automobile ........... $ 5,000 Proceeds...

-

To prepare its statement of cash flows for the year ended December 31, 2012, McKinney Carterette Cataloging Specialists, Inc., gathered the following information: Dividends paid ............... $...

-

You are an audit supervisor of PricewaterhouseCoopers (PwC) and are planning the audit of your client, Blister Pharmaceuticals co. which manufactures and imports sanitary and cleaning products...

-

Explain how the concepts in this chapter account for each of the following scenarios: a. Most people rate death by shark attacks to be much more likely than death by falling airplane parts, yet the...

-

State whether each of the following expressions are identities or equations. Where appropriate, use any method to identify the values of such that the equations hold. . y-16 = (y-4) (y + 4) a. b. y...

-

Pillow Company is purchasing an 80% interest in the common stock of Sleep Company. Sleeps balance sheet amounts at book and fair value are as follows: Book Fair Account Value Value Current assets . ....

-

Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Three years after its purchase, one of Kara's buildings has a carrying value of...

-

During May, the following changes in inventory took place: SHOW ALL CALCULATIONS May 1 14 Balance Purchases Purchases 1,100 units @ $25 = 800 units @ $36 700 units @ $30 = $27,500 2 8,800 21,000 24...

-

In gathering data for its pay policies, what product markets would a city's hospital want to use as a basis for comparison? What labor markets would be relevant? How might the labor markets for...

-

A comparative statement of financial positions as at 31 December 2019 and 2020 for Flowers Ltd is shown below. Sales for 2020 were $180 000 and profit after tax was $16350. Cost of sales was $136456....

-

Tom and Clancy Partners reported a profit of $76000 for the year. The statement of profit or loss also showed depreciation expense of $8000 and a loss on the sale of a motor vehicle of $2000. The...

-

Catch a Wave Company manufactures surfboards. Its standard cost information follows. Catch a Wave has the following actual results for the month of June: Required: Calculate the following variances...

-

Could I obtain assistance with these . problems? 1. Find the coordinates of the turning points of the curve y=3x^4-8x^3-30x^2+72x+5. Determine the nature of these points. "Determine the nature"...

-

1 . In 1 9 6 0 the homeownership rate in the United States was 6 2 % . Is there evidence to indicate that the homeownership rate is now higher? To answer the question, the researchers sample 5 0 2...

-

A certain disease is classified into 4 stages that distinguish how developed the disease is. Researchers studying a new potential treatment recruited over 100 patients with varying stages of the...

-

1. (20) Let and Dor {abnm or 2n m} = Dand = {a"b" nm and 2n m}. Prove that Dor and Dand are both context-free.

-

Given n samples 1 , 2 , . . . , x 1 ,x 2 ,...,x N drawn independently from a Poisson distribution unknown parameter , find the MLE of . = = 1 MLE = i=1 n x i = = 1 MLE =n i=1 n x i = = 1 MLE = i=1 n...

-

Your favorite television station transmits using an electromagnetic wave with a wavelength of approximately 1.5 m. What is the frequency?

-

Difference between truncate & delete

-

Using your knowledge of the accounting equation, solve the missing values in the following table: Assets Liabilities Equity 100 000 20 000 a. 67000 20 000 d. 30000 95 000 C. 8300 5 500+

-

From the following descriptions of business items, choose appropriate column headings for the worksheet. Justify for each description your choice of heading. a. The amount the owner contributed to...

-

Distinguish between personal transactions and business transactions. Illustrate with five examples of each.

-

En prenant un exemple de votre choix, montrer comment on value un swap de taux de change.

-

How much would you need to invest today in order to receive: a. $10,000 in 5 years at 11%? b. $11,000 in 12 years at 8%? c. $12,000 each year for 10 years at 8%? d. $12,000 at the beginning of each...

-

A company that manufactures pulse Doppler insertion flow meters uses the Straight Line method for book depreciation purposes. Newly acquired equipment has a first cost of $190,000 with a 3-year life...

Study smarter with the SolutionInn App