A and B are in partnership sharing profits and losses in the ratio 3:2. Their last balance

Question:

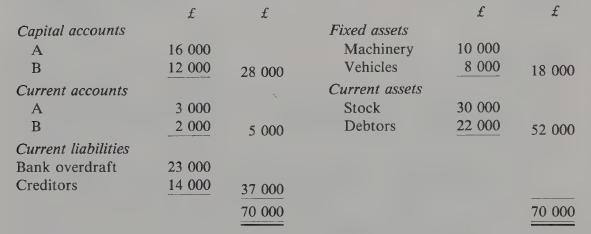

A and B are in partnership sharing profits and losses in the ratio 3:2. Their last balance sheet as at 31 December 19-4 was as follows:

The partnership has been profitable over many years and although profitability has been maintained, recently the firm has suffered from cash ™

flow problems. In addition to the cash flow problems, the partnership needs to reinvest in fixed assets at a cost of £42 000. Profits have been £40 000 per annum over the last three years and it is anticipated that the same level of profit will continue during the present year. Profit accrues evenly throughout the year.

A and B are considering two alternative methods of raising the necessary funds from 1 July 19_5S.

(1) To purchase the fixed assets on hire purchase over a period of three years. The hire purchase agreement provides for 36 equal instalments of £1 500. (It can be assumed that interest is applied evenly over the three years.) In addition a long-term loan of £30 000 is available from a finance company at 15% interest with only the interest being repayable over the first two years.

(2) To accept into the partnership a new partner C on the following terms from 1 July 19_S.

That C will bring into the partnership £60 000 cash as capital.

That the partners will be entitled to interest at a rate of 15% per year on fixed capital.

That A and B will be entitled to a salary of £3 200 per annum and £2 000 per annum respectively.

That the balance of profits and losses will be shared equally between the partners.

Required:

(a) A forecast profit and loss appropriation account for the year ending 31 December 19_5 assuming that alternative (1) is accepted showing clearly the adjusted net profit figure prior to appropriation.

(b) A forecast profit and loss appropriation account for the year ending 31 December 19_5 assuming that alternative (2) is accepted.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir