Thorn and Snail are in partnership manufacturing and distributing two products, Product A and Product B. The

Question:

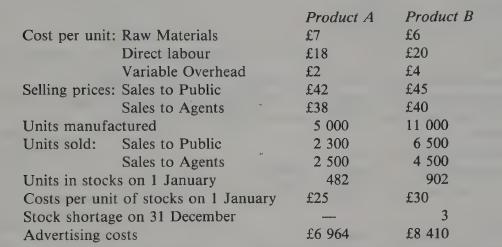

Thorn and Snail are in partnership manufacturing and distributing two products, Product A and Product B. The following information is available for Year 4:

Fixed Overheads £60 000. Partners’ drawings: Thorn £39 217; Snail £30 783. Partners’ capitals on 1 January: Thorn £140 000; Snail £120 000.

Additional capital introduced by Snail on 1 July: £20 000. Sundry net assets other than stocks on 31 December: £294 616.

There were no raw materials or partly manufactured goods in stock either at the beginning or at the end of Year 4. Finished units are valued on a first in first out basis at their raw material, direct labour and variable overhead costs.

The partnership agreement provides for:-

(1) Interest on partners’ capital at 7% per year.

(2) Thorn to receive as commission 5% of the net profit on Product A (before charging fixed overheads) and Snail to receive as commission 4% of the net profit on Product B (before charging fixed overheads).

(3) The balance of profits (or losses) to be divided between Thorn and Snail in the ratio of 11:9.

Required:

(a) Prepare a Trading, Profit and Loss, and Appropriation Account of the partnership for the year ended 31 December Year 4.

(b) Prepare the Balance Sheet of the partnership at 31 December Year 4.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir