Charles is a wholesaler of accounting stationery. He conducts his business froma small warehouse which he owns.

Question:

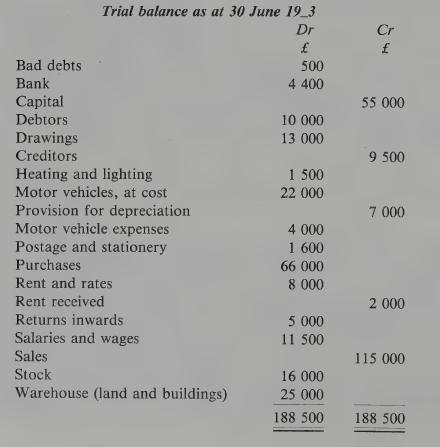

Charles is a wholesaler of accounting stationery. He conducts his business froma small warehouse which he owns. Part of the building is sub-let to another trader at an annual rent of £2 600. The following year-end trial balance “

has been extracted from his books at the close of business on 30 June 19_3:

Additional information:

(1) Stock at 30 June 19_3, £20 000 (2) Heating and lighting accrued at 30 June 19_3, £500. ‘

(3) The fall in value of the delivery vans during the year is estimated at £5000.

(4) Charles frequently takes home stationery for personal use. The total value of goods taken over the year is estimated at £2 000.

Required:

Charles’ trading and profit and loss account for the year ended 30 June 19_3 and a balance sheet as at that date.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir