Heath and Rowe are partners sharing profits/losses in the ratio of 3:2 respectively. Their financial year ends

Question:

Heath and Rowe are partners sharing profits/losses in the ratio of 3:2 respectively. Their financial year ends on 31 December.

At 1 January 19_2 the firm owned two light aircraft: A, which had been bought on 1 January 19_0 for £32 000, and B, bought on 1 July 19_1 for £58 000. Up to 31 December 19_1 the depreciation charge on them had been calculated at an annual rate of 20% on a straight line basis, assuming residual values of £4 000 for A and £6 000 for B. No separate provision account was maintained.

On 1 January 19_2 the partners decided that:

(1) A separate depreciation provision account would be kept.

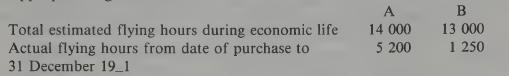

(2) Depreciation should be provided on the basis of an hourly rate related to estimated flying hours, but with estimated residual values unchanged.

Appropriate figures were:

(3) Adjustments should be made in the firm’s books to put (1) and (2) into effect, retrospective to 1 January 19_0.

On 27 May 19_2 the firm bought aircraft C for £60 000. Its estimated flying hours were 15 000, and its residual value £7 500.

In September 19_2 aircraft A was converted into a training plane at a cost of £6 900 and, in addition, £3 200 was spent on a major engine overhaul. It is not anticipated that either of these factors will affect the estimated flying hours of the aircraft or its residual value.

Total flying hours during 19_2 were:

A. 2 350 (including 1 900 before September)

B. 1980.

C. 2 200

(3) Adjustments should be made in the firm’s books to put (1) and (2) into effect, retrospective to 1 January 19_0.

On 27 May 19_2 the firm bought aircraft C for £60 000. Its estimated flying hours were 15 000, and its residual value £7 500.

In September 19_2 aircraft A was converted into a training plane at a cost of £6 900 and, in addition, £3 200 was spent on a major engine overhaul. It is not anticipated that either of these factors will affect the estimated flying hours of the aircraft or its residual value.

Total flying hours during 19_2 were:

A. 2 350 (including 1 900 before September)

B. 1980.

C. 2 200 Required:

(a) A journal entry to give effect to items (1), (2) and (3).

(Narrations are not required.)

(b) The following ledger accounts for the year 19_2:

(i) Aircraft (ii) Provision for depreciation of aircraft.

(c) Comment briefly on the partners’ decision in item (3), in the light of SSAP 12.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir