. Parks, Langridge, and Sheppard were in partnership sharing profits and losses: Parks one-half, Langridge one-third and...

Question:

. Parks, Langridge, and Sheppard were in partnership sharing profits and losses: Parks one-half, Langridge one-third and Sheppard one-sixth.

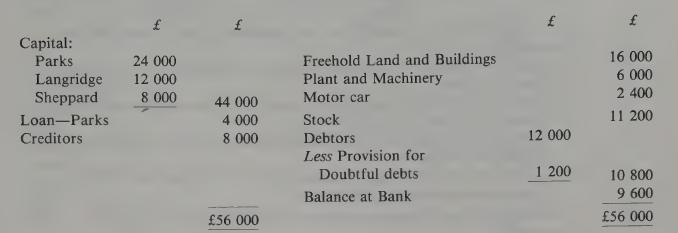

The firms’ summarized Balance Sheet as on 31 March 19_5 was as follows:

Parks retired on 31 March 19_5 to commence business on his own account and Langridge and Sheppard continued in partnership, sharing profits in the ratio: Langridge two-thirds, Sheppard one-third.

It was agreed that Parks should take over certain plant and machinery valued at £1 500 and one of the firm’s cars at its book value of £1 000.

It was further agreed that the following adjustments should be made in the Balance Sheet as on 31 March 19_5:

(1) Freehold land and buildings should be revalued at £20 000 and plant and machinery, inclusive of that taken over by Parks, at £5 000.

(2) The provision for doubtful debts should be increased by £300.

(3) A provision of £500 included in creditors for a possible claim for damages was no longer required.

(4) The stock should be reduced by £800 for obsolete and damaged items.

In accordance with the terms of the partnership agreement, the total value of goodwill on 31 March 19_5 was agreed at £30 000. Since Parks intended to retain certain of the customers it was agreed that the value of the proportion of the goodwill to be purchased by him was £6 000. Langridge and Sheppard decided that goodwill should not appear in the books of the new partnership as an asset, the necessary adjustments being made through the partners’ Capital Accounts. Pending the introduction of further cash capital by the continuing partners, the amount owing to Parks was agreed to be left on loan account.

Required:

(a) the Revaluation Account;

(b) the partners’ Capital Accounts in columnar form of the old and new firm, recording these transactions;

(c) the opening Balance Sheet of the new firm.

(d) What is the reasoning behind the adjustments made for goodwill?

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir