A, B, and C are in partnership, sharing profits and losses in the ratio 7:3:2 respectively. The

Question:

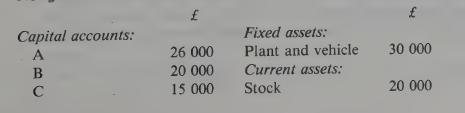

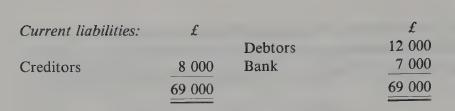

A, B, and C are in partnership, sharing profits and losses in the ratio 7:3:2 respectively. The summarized balance sheet of the partnership as at 30 November 19_3 was as follows:

On 1 December 19_3 C retired from the partnership. The following matters were agreed:

(1) The car owned by the partnership would be transferred to C at its book value of £2 000.

(2) The remaining fixed assets, which remain in the partnership, would be valued at £32 000.

(3) Stock would be valued at £21 000, Debtors at £11 500, and Goodwill was agreed at £5 000.

(4) £1 000 cash would be paid immediately to C, the balance due to him to remain as a loan to the partnership.

C’s retirement was followed immediately by the admission of D to the partnership.

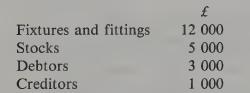

As her capital, D transferred to the partnership her existing business assets and liabilities as follows:

D’s business was valued at £21 000 for the purpose of its transfer to the partnership. A, B, and D are to share profits and losses in the ratio 5:4:2 respectively.

A goodwill account is to be maintained to record all relevant transfers of goodwill between A, B, and C, and A, B, and D respectively.

Required:

(a) Prepare the capital accounts of A, B, C, and D recording the transactions of 1 December 19_3, and bringing down the balances on that date.

(b) Prepare the partnership balance sheet as at 1 December 19_3 immediately after all the above transactions have taken place.

(c) Explain the meaning of ‘goodwill’.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir