Ray Dyo, Harfy UIl, and Val Vez are in partnership, trading under the name of Radtel Services,

Question:

Ray Dyo, Harfy UIl, and Val Vez are in partnership, trading under the name of Radtel Services, as radio and television suppliers and repairers, sharing profits and losses in the ratio one half, one third, and one sixth, respectively. Val Vez works full-time in the business with responsibility for general administration for which she receives a partnership salary of £4 000 per annum.

All partners receive interest on capital at 5% per annum and interest on any loans made to the firm, also at 5% per annum.

It has also been agreed that Val Vez should receive not less than £4 000 per annum in addition to her salary. Any deficiency between this guaranteed figure and her actual aggregate of interest on capital, plus residual profit (or less residual loss) less interest on drawings, is to be borne by Dyo and UII in the ratio in which they share profits and losses; such deficiency can be recouped by Dyo and UII at the earliest opportunity during the next two consecutive years provided that Val Vez does not receive less than the guaranteed minimum described above. During the year ended 30 September 19_3, Dyo and UIll had jointly contributed a deficiency of £1 500.

Radtel Services rents two sets of premises — one, a workshop where repairs are carried out, the other, a shop from which radio and television sets are sold. The offices are situated above the shop and are accounted for as part of the shop.

The workshop and shop are regarded as separate departments and managed, respectively, by Phuges and Sokkitt who are each remunerated by a basic salar¥ plus a commission of one ninth of their departments’ profits after charging their commission.

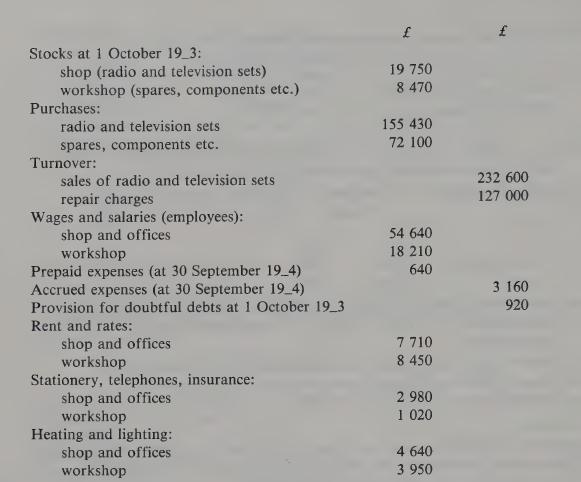

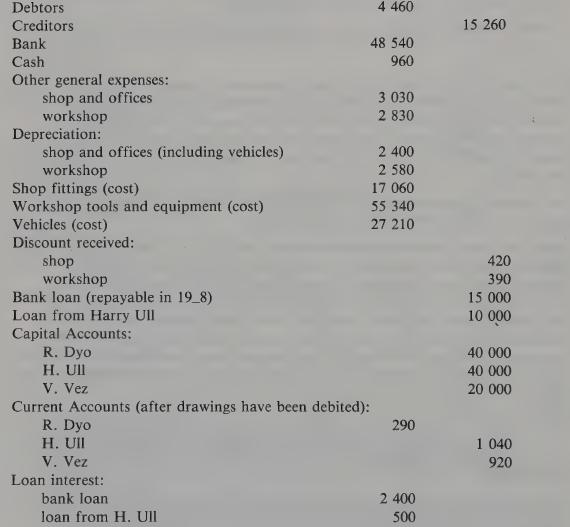

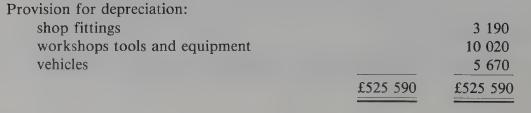

The trial balance of the firm on 30 September 19_4 is given on the following page.

The following matters are to be taken into account:

(1) Managers’ commissions.

(2) Partnership salary (Vez). .

(3) Interest on partners’ capital accounts (these have not altered during the year).

(4) Interest on partners’ drawings; Dyo £70; Ull £30; Vez £20.

(5) Closing stocks: shop £31 080, workshop £10 220.

(6) Provision for doubtful debts at 30 September 19_4, £540.

(7) Residual profits/losses.

N.B. Loan interést and the movement in the provision for bad debts are regarded as ‘shop’ items.

Required:

(a) Prepare columnar departmental trading and profit and loss accounts and a partnership appropriation account for the year ended 30 September 19_4 and the partnership balance sheet at that date.

(b) Complete the posting of the partners’ current accounts for the year.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir