Imagine a hotel operator is considering which out of two potential investment opportunities, Project A or Project

Question:

Imagine a hotel operator is considering which out of two potential investment opportunities, Project A or Project B, it will promote to the owner of a hotel it manages. Project A will require an initial investment of

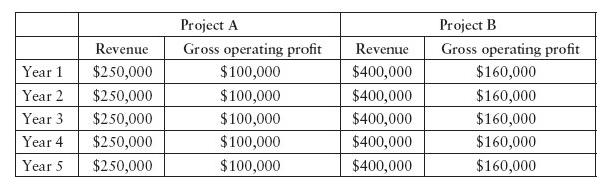

$500,000 and Project B will require an initial investment of $2,000,000. e projected revenue and profit projections associated with the two investment alternatives are outlined below.

The operator’s fee is determined as 3 per cent of gross revenue (base fee) and 10 per cent of gross operating profit (incentive fee).

Required:

a) Calculate the impact on the annual operator’s fee that would result from investing in Project A vs Project B. Based on this calculation, indicate which of the two projects the hotel operator would likely prefer.

b) Calculate the annual ROI of the two projects. Based on this calculation, which project would you expect the hotel owner to prefer?

Step by Step Answer:

Accounting Essentials For Hospitality Managers

ISBN: 9780415841092

3rd Edition

Authors: Chris Guilding