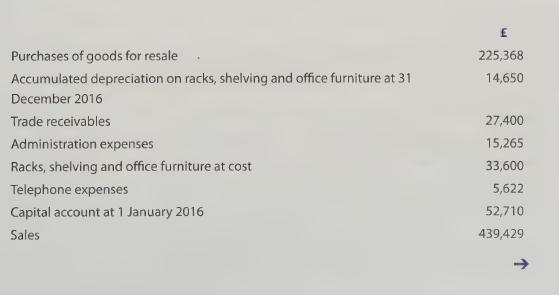

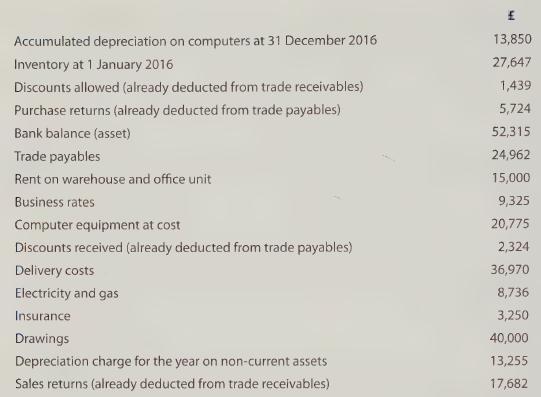

Alison runs an online gift shop, trading for cash with individual customers and offering trading on credit

Question:

Alison runs an online gift shop, trading for cash with individual customers and offering trading on credit terms to businesses. She presents you with the following account balances for the year ended 31 December 2016:

Alison provides you with the following additional information.

• Alison valued the inventory at 31 December 2016 at a cost of £22,600.

• All depreciation charges on non-current assets for the year to 31 December 2016 are included in the depreciation figures above.

• Renton the trading unit prepaid at 31 December 2016 amounted to £3,000.

• Rates prepaid at 31 December 2016 amounted to £1,865.

• Accountancy costs of £1,250 had not been paid by the year end and are not included in the figures above.

• There were no other prepaid or accrued expenses at the year end.

• Alison would like to include a provision for doubtful debts of 10% of year-end trade receivables.

There was no provision for doubtful debts at 31 December 2016.

Required

Using the list of balances and the additional information prepare Alison’s simplified income statement for the year ended 31 December 2016 together with a statement of financial position at that date.

Step by Step Answer: