Question

CASH MANAGEMENT Dr. Umburgh noticed that the $100.00 check made to Trenton Medical Supplies has not cleared for four months. What type of check is

CASH MANAGEMENT

- Dr. Umburgh noticed that the $100.00 check made to Trenton Medical Supplies has not cleared for four months. What type of check is the outstanding check referred to as?

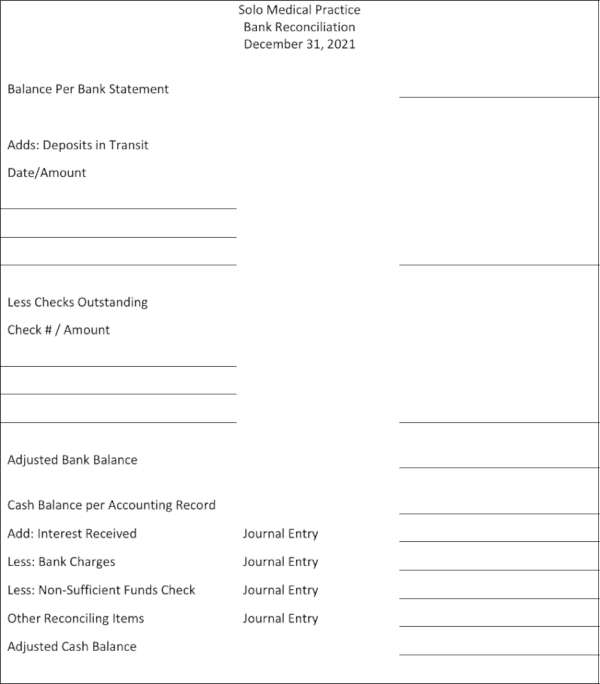

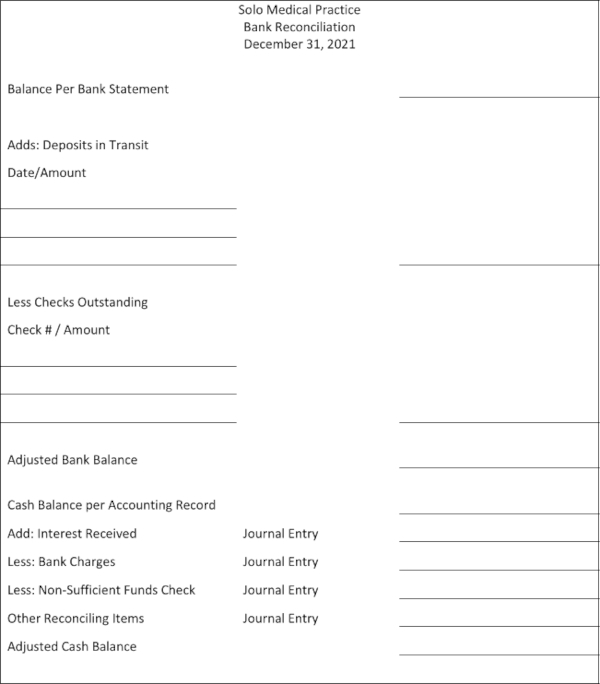

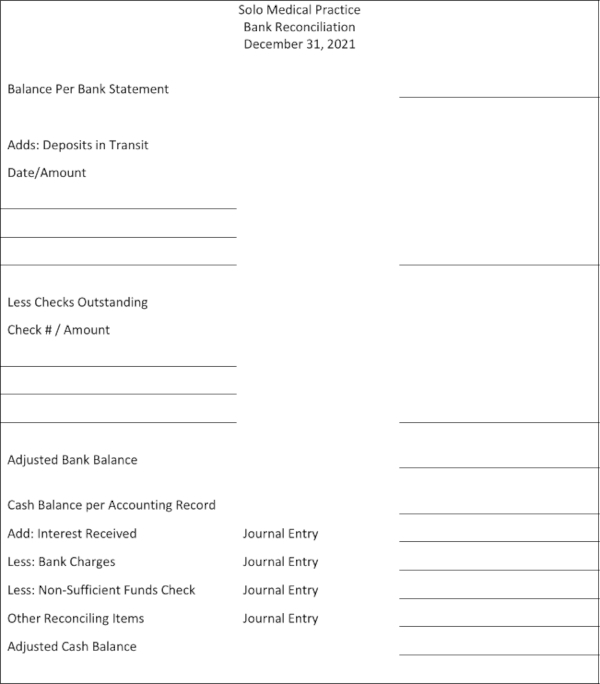

Dr. Solo is preparing a single journal entry for December 31, 2022. The bank statement shows a balance of $10,500 on that day. Three checks were made out on that day: one for $250 for medical supplies, the second for $175 for computer software, and the third for $105 for hand sanitizers. A deposit for $9,000 is not showing on the bank statement. For December, the bank has credited interest to the account for $85 and charged a bank service fee of $55. There is a non-sufficient funds check for $55.00. You will prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the adjusted cash balance?"

Dr. Solo is preparing a single journal entry for December 31, 2022. The bank statement shows a balance of $10,500 on that day. Three checks were made out on that day: one for $250 for medical supplies, the second for $175 for computer software, and the third for $105 for hand sanitizers. A deposit for $9,000 is not showing on the bank statement. For December, the bank has credited interest to the account for $85 and charged a bank service fee of $55. There is a non-sufficient funds check for $55.00. You will prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the total of bank deposit(s) in transit shown on the reconciliation?

Dr. Solo is preparing a single journal entry for December 31, 2022. The bank statement shows a balance of $10,500 on that day. Three checks were made out on that day: one for $250 for medical supplies, the second for $175 for computer software, and the third for $105 for hand sanitizers. A deposit for $9,000 is not showing on the bank statement. For December, the bank has credited interest to the account for $85 and charged a bank service fee of $55. There is a non-sufficient funds check for $55.00. You will prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the total of the adjusted bank balance?"

- Ginger Tyler comes into Johns Medical Center for her routine office visit. Her co-payment is $50.00. She hands the office manager $60.00. The $10.00 change should be taken from which cash management?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Outstanding Check Type Dr Umburgh noticed that the 10000 check made to Trenton Medical Supplies has not cleared for four months This type of check i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started