During 2025, Truong Ltd disposed of four different non-current assets. On 1 January 2025 the accounts were

Question:

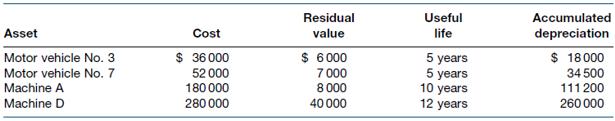

During 2025, Truong Ltd disposed of four different non-current assets. On 1 January 2025 the accounts were as follows.

Truong Ltd depreciates its motor vehicles and machines by the straight-line method and records depreciation to the nearest month. Assets were disposed of as follows.

• Motor vehicle No. 3, which was not insured, was completely destroyed by fire on 6 January 2025. A towing company was paid \($1000\) to remove the motor vehicle and to clean up any debris.

• Motor vehicle No. 7 was traded in on a new motor vehicle on 3 July 2025. The new motor vehicle had a cash price of \($56\) 000. The old motor vehicle plus cash of \($26\) 000 were given in exchange.

• Machine A was sold for \($100\) 000 cash on 1 October 2025.

• Machine D was traded in on a new machine with a cash price of \($300\) 000 on 24 December 2025. The old machine plus cash of \($290\) 000 were given in exchange.

Required

(a) Prepare all general journal entries to record the transactions. Ignore GST.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie