During 2019, Truong Ltd disposed of four different noncurrent assets. On 1 January 2019 the accounts were

Question:

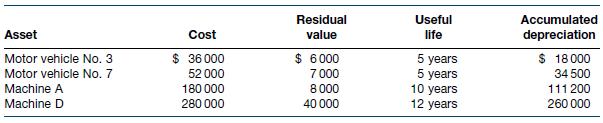

During 2019, Truong Ltd disposed of four different non‐current assets. On 1 January 2019 the accounts were as follows.

Truong Ltd depreciates its motor vehicles and machines by the straight‐line method and records depreciation to the nearest month. Assets were disposed of as follows.

• Motor vehicle No. 3, which was not insured, was completely destroyed by fire on 6 January 2019. A towing company was paid $1000 to remove the motor vehicle and to clean up any debris.

• Motor vehicle No. 7 was traded in on a new motor vehicle on 3 July 2019. The new motor vehicle had a cash price of $56 000. The old motor vehicle plus cash of $26 000 were given in exchange.

• Machine A was sold for $100 000 cash on 1 October 2019.

• Machine D was traded in on a new machine with a cash price of $300 000 on 24 December 2019. The old machine plus cash of $290 000 were given in exchange.

Required

Prepare all general journal entries needed to account for the above transactions. Ignore GST.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield