It is the end of the month and David is happy with the good start to his

Question:

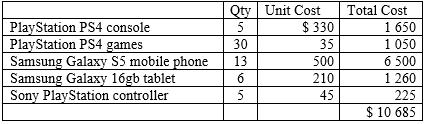

It is the end of the month and David is happy with the good start to his merchandising venture. He has completed a physical stocktake, to make sure stock levels are as expected, and so that a value for inventory on hand at the end of August could be calculated. The values shown in the table below are provided to assist with the preparation of the statement of profit or loss using the periodic inventory system.

Required

(a) Analysing/decision making When completing this part of the case, ignore the effects of GST. Your lecturer will provide you with a worksheet with the trial balance figures from the previous chapter. Then using the information provided below, prepare on the worksheet the adjusting journal entries to record to account for prepayments, accruals, and depreciation.

• Prepayments expired during the month are:

o Rent - \($990\) o Advertising - \($600\) o Insurance - \($125\) • Accrual adjustments:

o Transfer the amount recorded as telephone payable to the expense account.

o Electricity – accrue \($180\) • Depreciation on shop equipment & fittings is \($218\) for August.

• Interest charged to the bank loan account for August is \($211.

Complete\) the worksheet by determining the adjusted trial balance and the figures that should appear in the statement of profit or loss and statement of financial position.

(b) Recording Record the adjustments in the general journal and post them to the general ledger accounts used in the previous chapter.

(c) Reporting Prepare two statements of profit or loss, one using the periodic inventory system and one using the perpetual inventory system.

(d) Recording Record closing journal entries in the general journal, and post them to the general ledger. Close off the general ledger accounts.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie