On 1 July 2025, McGregor and Roberts decided to amalgamate their businesses and to share profits equally.

Question:

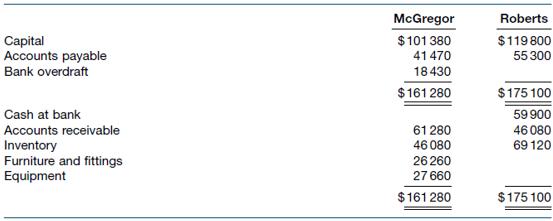

On 1 July 2025, McGregor and Roberts decided to amalgamate their businesses and to share profits equally. Financial information at that date was as follows.

At 1 July 2025, McGregor’s accounts receivable and inventory had fair values of \($61280\) and \($48380\) respectively, and Roberts’s accounts receivable and inventory had fair values respectively of \($46080\) and \($73720.\) McGregor’s equipment was written down by 10%.

McGregor and Roberts negotiated to have equal capital balances of \($150000\).

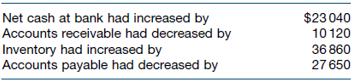

After 1 year, the following were the only changes to the assets and liabilities, as compared with the position at the time of forming the partnership.

Depreciation still has to be charged on the furniture and fittings and on equipment at the rates of 10% and 15% respectively for the year. Cash drawings for the year were: McGregor, \($28800;\) Roberts, \($36240\).

Required

(a) Prepare journal entries to record the formation of the partnership.

(b) Prepare a statement of changes in partner’s equity as at 30 June 2026 showing each partner’s share of profit/loss for the year.

(c) Prepare the balance sheet of the partnership as at 30 June 2026.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie