On 2 January 2024, Omega Ltd purchased, by exchanging ($420) 000 cash and a ($250) 000, 12%,

Question:

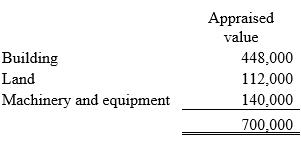

On 2 January 2024, Omega Ltd purchased, by exchanging \($420\) 000 cash and a \($250\) 000, 12%, 18-month finance company loan, assets with the following independently determined appraised values.

The estimated useful life of the building is 30 years and its residual value is \($40\) 000.

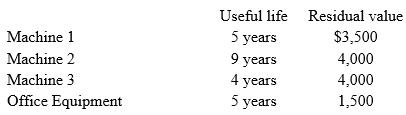

The \($140\) 000 machinery and equipment amount consists of three machines independently valued at \($41\) 000 each and some office equipment valued at \($17\) 000. The estimated useful lives and residual values for these assets are shown below.

Omega Ltd uses the straight-line depreciation method. Ignore GST.

Required

(a) Prepare general journal entries to record the following transactions:

i. the purchase of the assets ii. the accrual of interest expense on the loan on 31 December 2024 iii. depreciation expense for the year 2024 iv. the payment of the loan on 2 July 2025.

(b) Show how the assets would be reported in the Statement of Financial Position on the 31 December 2024.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie