The Bigfork Company is a retail company that began operations on January 1,2018. The Bigfork Company is authorized to issue 1,000,000 shares of P10 par

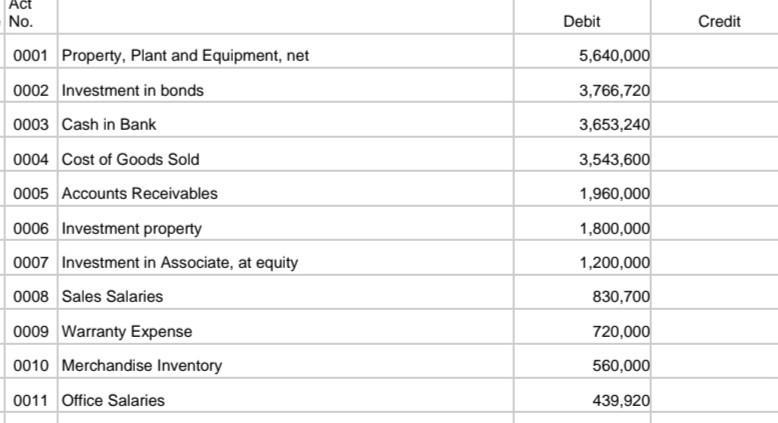

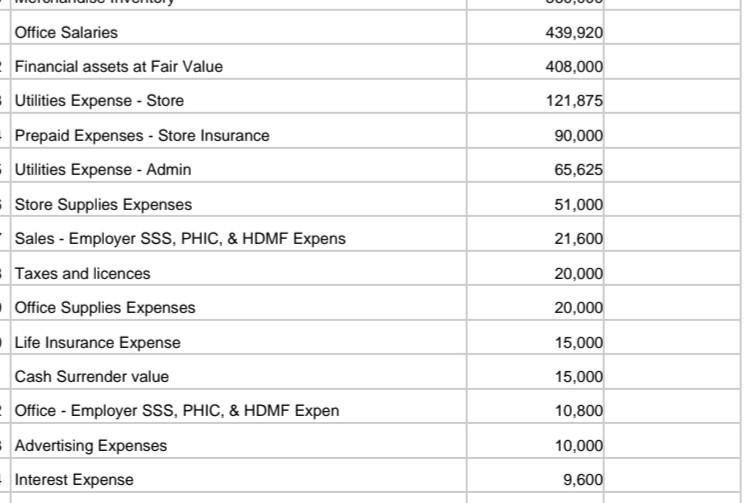

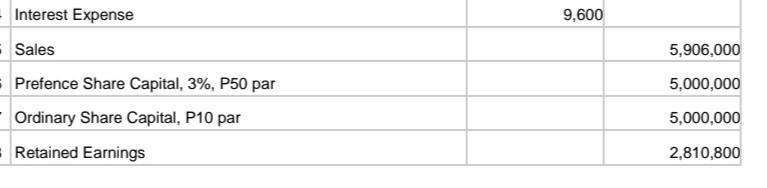

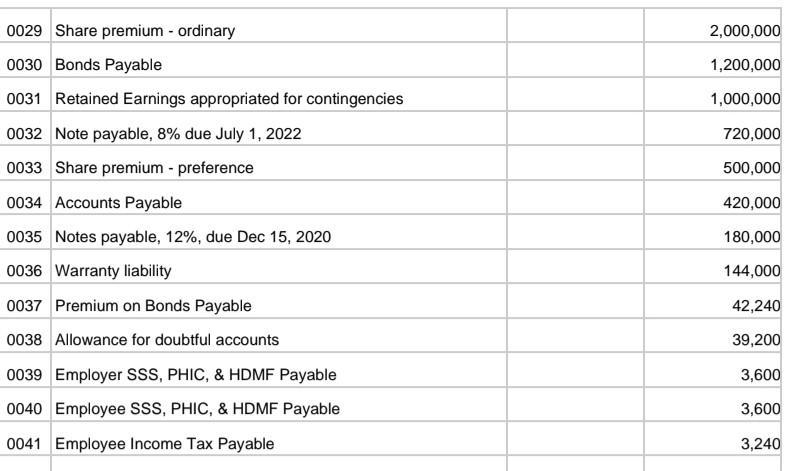

The following is the trial balance of Bigfork Company as of September 30, 2022:

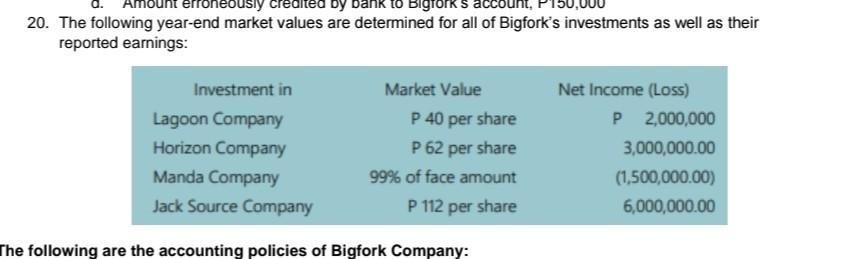

2) The investment in the bonds of Manda Company was acquired on April 1, 2022 with a face amount of P4,000,000, for P3,766,720. The bonds mature on April 1, 2026 and pays 12% interest annually on April 1 with a 14% effective yield. The investment is to be held as financial asset at amortized cost.

2) The investment in the bonds of Manda Company was acquired on April 1, 2022 with a face amount of P4,000,000, for P3,766,720. The bonds mature on April 1, 2026 and pays 12% interest annually on April 1 with a 14% effective yield. The investment is to be held as financial asset at amortized cost.

(3) The investment property is a vacant land that was acquired during 2020 and currently has undetermined use.

(4) On January 1, 2022, Bigfork purchased 20,000 shares of Horizon Company, P30 par at P60 per share, representing 20% equity interest. At the time of acquisition, the net assets of the investee are fairly stated.

(5) Bigfork purchased 10,000 shares of marketable equity securities of Lagoon Company on June 1, 2022, for P 408,000 and held these as financial assets for trading.

(6) The one-year store insurance policy was purchased last October 1, 2021 for an annual premium of P120,000.

(8) The 3-year, P1,200,000 face amount, 10% bonds was issued by Bigfork on January 1, 2022 for P1,242,240, with an effective yield of 8%. The principal and interest are payable annually starting on December 31, 2022.

(8) The 3-year, P1,200,000 face amount, 10% bonds was issued by Bigfork on January 1, 2022 for P1,242,240, with an effective yield of 8%. The principal and interest are payable annually starting on December 31, 2022.

(9) The P720,000 note payable was a 2-year, 8% promissory note, issued on July 1, 2022. Principal payment is due on maturity date but interest is payable every first of the month, beginning August 1, 2022.

(10) The 12%, P180,000 note payable was a 6-month promissory note, issued on June 15, 2022. Interest was payable at maturity date.

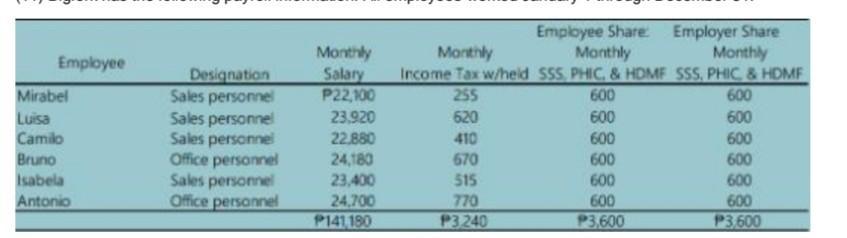

(11) Bigfork has the following payroll information. All employees worked January 1 through December 31:

The Bigfork Company completed the following transactions during the last quarter of 2022:

The Bigfork Company completed the following transactions during the last quarter of 2022:

OCTOBER 2020

Issued 100,000 shares of P10 par value ordinary share for cash of P15 per share.

Issued 30,000 preference shares for cash of P60 per share.

Issued a P2,400,000, 10-year, 9% mortgage payable for land with an existing store building. Mortgage payments of P20,000 plus interest based on the outstanding balance of mortgage are due on the first day of each month, beginning November 1. The assets had the following market values: Land, P200,000; Building, P800,000.

Issued a one-year, 10% note payable for P100,000 for office fixtures. The principal and interest are due October 1, 2023.

Paid the renewal of annual store insurance premium of P120,000.

Paid interest due on the 8% note payable issued last July 1, 2022.

Purchased merchandise inventory on account for P1,250,000, terms n/30.

Paid P400,000 of accounts payable

Collected 80% of accounts receivables.

Paid P16,000 for utilities.

Paid all liabilities associated with the September 30 payroll.

Received a cash dividend of P1.60 per share from Lagoon Company.

Recorded cash sales for the month of P560,000 and credit sales of P1,290,000. The cost of the goods sold was P1,100,000 and estimated warranty payable was 8%.

Recorded October payroll and paid employees.

Accrued employer additional payroll contributions for October.

NOVEMBER 2020

Paid the first mortgage payment.

Purchased 6,000 ordinary shares at P110 per share of Jack Source Co. as a long-term investment, representing 4% ownership. Bigfork irrevocably designate this investment at fair value through other comprehensive income.

Paid interest due on the 8% note payable issued last July 1, 2022.

Paid suppliers for merchandise inventory purchased on October 3.

Purchased merchandise inventory on account for P1,500,000, terms n/30.

Collected 80% of accounts receivable.

Purchased 50,000 ordinary shares as treasury for P16 per share. These shares were originally issued for P14 per share.

Paid all liabilities associated with the October 31 payroll.

Paid P60,000 to satisfy warranty claims.

Declared cash dividends of P2 per outstanding share to ordinary shareholders and the preference dividends at the preference rate.

Paid P24,500 for utilities.

Received a cash dividend of P6.6 per share on the Jack investment.

Paid the cash dividends declared on November 17.

Recorded cash sales for the month of P420,000 and credit sales of P980,000 The cost of the goods sold was P840,000 and estimated warranty payable was 8%.

Recorded November payroll and paid employees.

Accrued employer additional payroll contributions for November.

DECEMBER 2020

Paid the second mortgage payment.

Paid interest due on the 8% note payable issued last July 1, 2022.

Received a cash dividend of P4.80 per share from Horizon Company.

Paid suppliers for merchandise inventory purchased on November 10.

Collected 80% of accounts receivable.

Paid P100,000 to satisfy warranty claims.

Sold 30,000 shares of treasury share for P15 per share.

Paid all liabilities associated with the November 30 payroll.

Paid the principal and interests of the note payable issued last June 15, 2022.

Declared a 10% share dividend to all outstanding ordinary shares to be distributed on December 30, 2022 to shareholders of record December 24, 2022. The market value of the shares as of declaration date is P16 per share.

Paid P22,000 for utilities.

Purchased merchandise inventory on account for P900,000, terms n/30.

Distribute the share dividends.

Recorded cash sales for the month of P630,000 and credit sales of P1,470,000 The cost of the goods sold was P1,260,000 and estimated warranty payable was 8%.

Recorded December payroll and paid employees.

Accrued employer additional payroll contributions for December.

Paid the first series of the 10% P1,200,000 bonds and the annual interest.

A physical inventory count conducted revealed total cost of P1,000,000. The entity also determined that the net realizable value of inventory was P1,100,000.

The bank statement as of December 31, 2022 showed a balance of P5,973,670.00. Upon comparing the statement with the cash records, the following facts were determined:

The bank debited service charges for December of P10,000.

Receipts for December 31, 2022 for P500,000 were not recorded by bank until January 2, 2023.

Checks outstanding on December 31, 2022 totaled P685,000

Amount erroneously credited by bank to Bigfork’s account, P150,000

The following are the accounting policies of Bigfork Company:

1. Investment properties are measured using cost model

A full year depreciation is taken in the year of acquisition and no depreciation is taken in the year of disposition.

The accounting policy is to report inventory at lower of cost and net realizable value applied to total inventory. Cost is determined under the first-in, first-out method. The entity used the direct write-off method of recording inventory write-down. Any inventory loss will be charged directly to cost of goods sold account.

In estimating allowance for doubtful accounts, the entity used percentage of accounts receivables. The policy is to maintain an allowance for doubtful accounts equal to 10% of the outstanding accounts receivable.

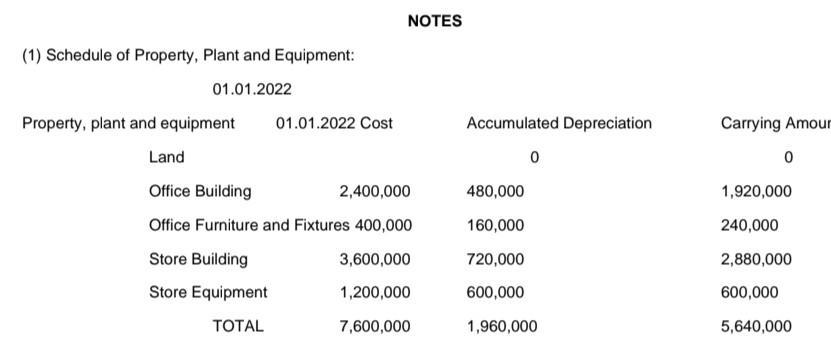

The entity opted to use the straight line method of depreciation for all property, plant and equipment. Residual values are ignored because they are considered immaterial. The following are the estimated useful life of the properties:

Office Building 20 years

Office Furniture and Fixtures 5 years

Store Building 20 years

Store equipment 6 years

Requirement: Prepare Journal Entry and T-account

Act No. 0001 Property, Plant and Equipment, net 0002 Investment in bonds 0003 Cash in Bank 0004 Cost of Goods Sold 0005 Accounts Receivables 0006 Investment property 0007 Investment in Associate, at equity 0008 Sales Salaries 0009 Warranty Expense 0010 Merchandise Inventory 0011 Office Salaries Debit 5,640,000 3,766,720 3,653,240 3,543,600 1,960,000 1,800,000 1,200,000 830,700 720,000 560,000 439,920 Credit

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started