Answered step by step

Verified Expert Solution

Question

1 Approved Answer

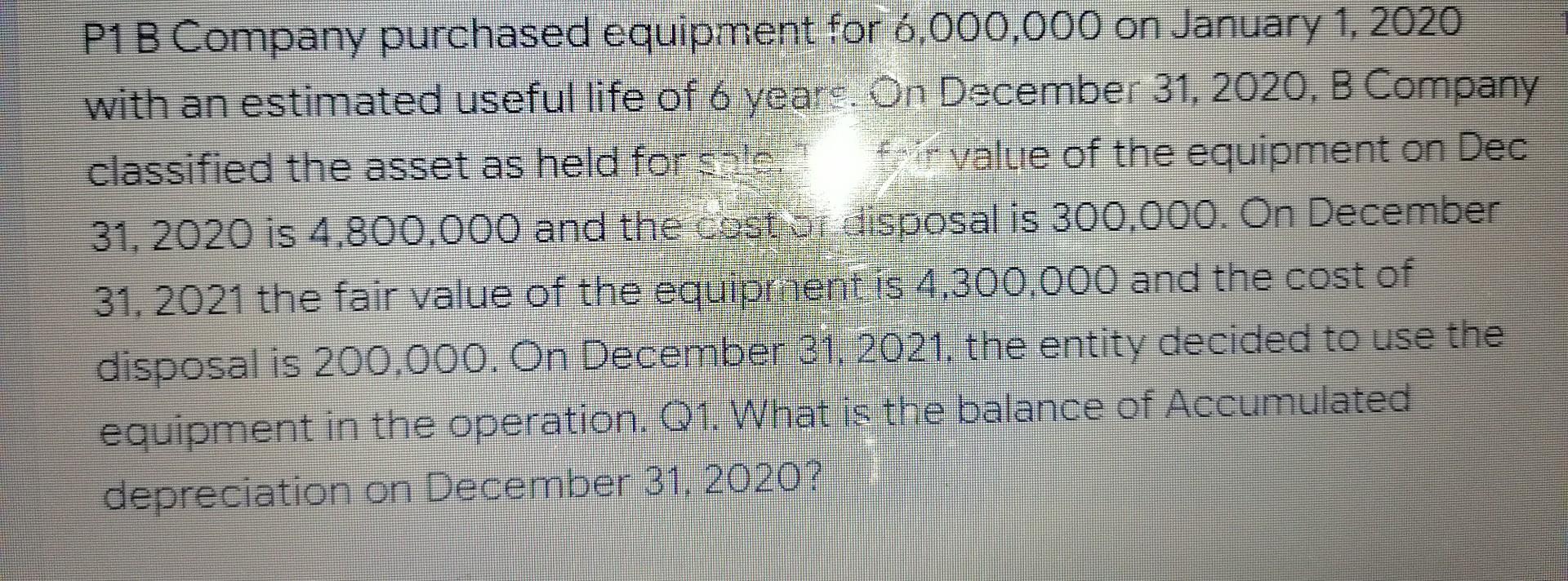

P1 B Company purchased equipment for 6,000,000 on January 1, 2020 with an estimated useful life of 6 years. On December 31, 2020, B

P1 B Company purchased equipment for 6,000,000 on January 1, 2020 with an estimated useful life of 6 years. On December 31, 2020, B Company classified the asset as held for sale. value of the equipment on Dec 31, 2020 is 4,800,000 and the cost or disposal is 300.000. On December 31, 2021 the fair value of the equipment is 4,300,000 and the cost of disposal is 200,000. On December 31, 2021, the entity decided to use the equipment in the operation. Q1. What is the balance of Accumulated depreciation on December 31, 2020? Refer to P1. What is the balance of non current asset held for sale by December 31, 2020? Refer to P1, What is the balance of gain impairment on December 31 2020?

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation It is an accounting procedure of apportioning the cost of a tangible asset over its ser...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started