Pioneer Manufacturing Ltd completed the following transactions during 2023: Required Prepare journal entries to record all the

Question:

Pioneer Manufacturing Ltd completed the following transactions during 2023:

Required Prepare journal entries to record all the transactions of Pioneer Manufacturing Ltd from 1 July 2023 to 30 June 2024.

Transcribed Image Text:

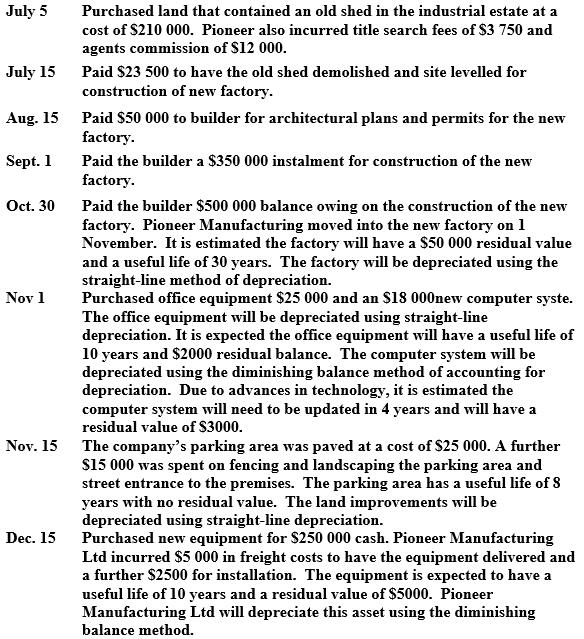

July 5 July 15 Aug. 15 Sept. 1 Oct. 30 Nov 1 Nov. 15 Dec. 15 Purchased land that contained an old shed in the industrial estate at a cost of $210 000. Pioneer also incurred title search fees of $3 750 and agents commission of $12 000. Paid $23 500 to have the old shed demolished and site levelled for construction of new factory. Paid $50 000 to builder for architectural plans and permits for the new factory. Paid the builder a $350 000 instalment for construction of the new factory. Paid the builder $500 000 balance owing on the construction of the new factory. Pioneer Manufacturing moved into the new factory on 1 November. It is estimated the factory will have a $50 000 residual value and a useful life of 30 years. The factory will be depreciated using the straight-line method of depreciation. Purchased office equipment $25 000 and an $18 000new computer syste. The office equipment will be depreciated using straight-line depreciation. It is expected the office equipment will have a useful life of 10 years and $2000 residual balance. The computer system will be depreciated using the diminishing balance method of accounting for depreciation. Due to advances in technology, it is estimated the computer system will need to be updated in 4 years and will have a residual value of $3000. The company's parking area was paved at a cost of $25 000. A further $15 000 was spent on fencing and landscaping the parking area and street entrance to the premises. The parking area has a useful life of 8 years with no residual value. The land improvements will be depreciated using straight-line depreciation. Purchased new equipment for $250 000 cash. Pioneer Manufacturing Ltd incurred $5 000 in freight costs to have the equipment delivered and a further $2500 for installation. The equipment is expected to have a useful life of 10 years and a residual value of $5000. Pioneer Manufacturing Ltd will depreciate this asset using the diminishing balance method.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie

Question Posted:

Students also viewed these Business questions

-

Over a 5-year period, Eureka Ltd completed the following transactions affecting non-current assets in financial years ending 30 June. The company uses straight-line depreciation on all depreciable...

-

7) The second financial statement to prepare is the statement of retained eamings. To determine the ending balance of retained earnings you need to start with the opening balance as reported in the...

-

The practical project involves two parts: Part A is the preparation of a selection of consolidation journal entries for an economic entity comprising a parent and a subsidiary. Part B is an...

-

Describe two methods for determining the molecular mass of a polypeptide. Which is more accurate and why?

-

David and Darlene Jasper have one child, Sam, who is 6 years old. The Jaspers reside at 4639 Honeysuckle Lane, Los Angeles, CA 90248. David's Social Security number is 577-11-3311, Darlene's is...

-

Let us consider a random linear constraint where a axb,

-

Ethical Dilemma: Northern Energy, Inc. (Northern) is a large oil company with production and marketing operations worldwide. You are a recently hired manager at Northerns subsidiary in Nigeria, which...

-

Assume that the tax rate is 35 percent. You can borrow at 8 percent before taxes. Should you lease or buy? You work for a nuclear research laboratory that is contemplating leasing a diagnostic...

-

answer questikns a-f 5. The local hiring manager Sukhwa from Target must decide whether to hire 1, 2, or 3 workers. He estimates that net revenues (in thousands) will vary with how well Hilo citizens...

-

Quick Smart Dry Cleaners Ltd uses the straight-line method for recording depreciation of its assets. The following is a summary of the non-current assets purchased during the second half of the...

-

On 2 January 2024, Omega Ltd purchased, by exchanging \($420\) 000 cash and a \($250\) 000, 12%, 18-month finance company loan, assets with the following independently determined appraised values....

-

What are the factors that may contribute to a decline in the value of sport sponsorship properties or limit a companys willingness to be involved in this form of activity?

-

7. Chicago Corp. obtained the following information from the Raw Materials Inventory account and purchasing records for the first quarter of the current year: Beginning Raw Materials Ending Raw...

-

Suppose that i t =6% (n=1), and that future short term interest rates (n=1) for the next 3 years (starting next year) are expected to be: 4%, 2%, 2%. Suppose that the liquidity premium is zero for...

-

Mechanical Vibrations HW Use the modal analysis and numerical integration to compute and plot the time response of the system, which has the equations of motion [8 0 01 (1) 48 -12 01(x1 0 0 8 02-12...

-

Submit excel file with graph and exchange rate analysis. FOREIGN EXCHANGE RATESTHE YEN FOR DOLLARS. The Federal Reserve System Web site, www.federalreserve.gov/releases/H10/hist , provides historical...

-

Part 1: There are many types of communication styles used in the workplace. Choose what you think is your leadership style: north, south, east, or west. Click The Leadership Compass Self-Assessment...

-

Suppose that an F-test (as described in this chapter using the classical approach) has a critical value of 2.2, as shown in this figure: a. What is the interpretation of a calculated value of F...

-

Gordon and Lisa estimate that they will need $1,875,000 in 40 years for their retirement years. If they can earn 8 percent annually on their funds, how much do they need to save annually?

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

Study smarter with the SolutionInn App