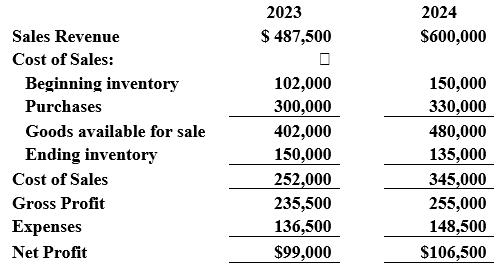

Presented below is the comparative Statement of Profit or Loss for Uniform Smart Ltd for the financial

Question:

Presented below is the comparative Statement of Profit or Loss for Uniform Smart Ltd for the financial years ended 30 June 2023 and 2024:

On preparing the inventory valuation for the 2024 financial reports, the following information was discovered regarding the 2023 inventory value. Ignore GST.

1. On 25 June, Uniform Smart Ltd purchased goods valued at \($3000\) from their supplier. The terms of purchase were EXW. The supplier delivered the goods to the arranged transport company on 26 June and were not included in the ending inventory value because they did not arrive to Uniform Smart’s premises until 3 July.

2. Uniform Smart Ltd also sells sun safe shirts, pants and boots on consignment in general stores in small regional towns. It was discovered \($9\) 000 of consigned inventory was counted in the physical stocktake.

3. Inventory totalling \($6\) 750 was purchased mid-June, it arrived on 29 June and was included in the year end physical stocktake, but was not recorded in the computerised system because the invoice did not arrive until early July.

4. Speedy Accountants Pty Ltd ordered \($3\) 500 of embroidered workwear, with a cost price \($2\) 000 on 20 June and did not want to collect the order until the new financial year. The staff member who completes the embroidery for Uniform Smart promptly completed the order before taking 3 weeks annual leave on 29 June. The order was included in the inventory valuation at 30 June.

5. Uniform Smart Ltd sold workwear and protective clothing to NQ Road Logistics Ltd on 26 June. Cost price of the goods amounted to \($5500\) with a recommended retail value of \($10000\). The terms shipping were DDP. The arrival of goods to NQ Road Logistics was delayed until the end of July due to flash floods from an extreme weather event. Uniform Smart recorded the sale in June and as the order left their premises on 27 June, the goods were excluded from the ending inventory.

Required

(a) Determine the correct ending inventory figure for 30 June 2023.

(b) Prepare revised Statement of Profit or Loss for 2023 and 2024.

(c) Determine the total profit for the 2-year period, both before and after the revisions. Why are these figures similar or different?

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie