Aroma Oils Ltd sells essential oils for aromatherapy. The business uses the perpetual inventory system with the

Question:

Aroma Oils Ltd sells essential oils for aromatherapy. The business uses the perpetual inventory system with the moving average cost flow method for inventory management and costing. The manager likes to keep her finger on the pulse and prepares monthly reports for the board of directors. All purchases and sales of inventory are made on credit. Reporting date is 31 December. Ignore GST.

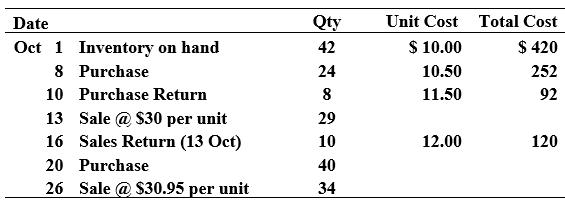

Sales and purchases of an essential oil, with a product code OL111022, during the month of October 2024 were as follows:

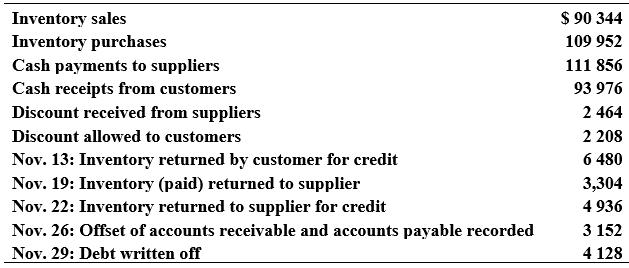

At the 31 October, the Accounts Receivable Control totalled \($69\) 280 Dr and the Accounts Payable Control totalled \($65\) 976 Cr.

Transactions involving customers and suppliers of Aroma Oils Ltd for the month of November 2024 are presented below:

The Inventory Control ledger account balance at 31 December 2024 was \($68\) 472, and net realisable value for each product line exceeded cost. The cost of inventory on hand at 31 December 2024, determined by physical count totalled \($68\) 808. In investigating the reasons for the discrepancy, the manager of Aroma Oils Ltd discovered the following:

• Goods costing \($920\) were ordered on 26 December 2024 on EXW terms. The transport firm took possession of the goods from the supplier on 28 December 2024. The purchase was recorded on 28 December 2024 but, as the goods had not yet arrived, the goods were not included in the physical count.

• \($2000\) of goods held on consignment for Beauty Scents Ltd were included in the physical count.

• Goods costing \($785\) were sold for \($905\) on 29 December 2024 on DDP terms. The sale was recorded on the 29 December and were posted to the customer the following day. They were not recorded in the physical stocktake because they were not on the premises on 31 December during the physical count.

Required

(a) Calculate the cost of sales and cost of inventory on hand at 31 October 2024 for essential oil # OL111022. (Round each average unit cost to the nearest cent, but round each total cost amount to the nearest dollar.)

(b) Prepare the Accounts Receivable Control and Accounts Payable Control general ledger accounts (T-format) for the period 31 October to 30 November 2024.

(c) Prepare any journal entries necessary on 31 December 2024 to correct error(s) and adjust inventory (Use the general journal).

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie