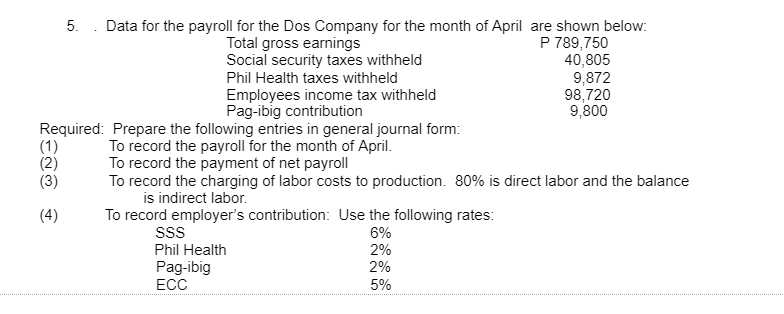

5. Data for the payroll for the Dos Company for the month of April are shown below: Total gross earnings Social security taxes withheld

5. Data for the payroll for the Dos Company for the month of April are shown below: Total gross earnings Social security taxes withheld Phil Health taxes withheld Employees income tax withheld Pag-ibig contribution Required: Prepare the following entries in general journal form: P 789,750 40,805 9,872 98,720 9,800 To record the charging of labor costs to production. 80% is direct labor and the balance (1) To record the payroll for the month of April. (2) To record the payment of net payroll (3) is indirect labor. (4) To record employer's contribution: Use the following rates: SSS 6% Phil Health 2% Pag-ibig ECC 2% 5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you sent shows the data for the payroll for the Dods company for the month of AprilThe total gross earnings is P 789750 Here are the journal entries to record the payroll for the month of Ap...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started