Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, Katniss Company borrowed P5,000,000 on a 10% three-year interest-bearing note. The net proceeds from the borrowing amounted to P5,000,000. Interest

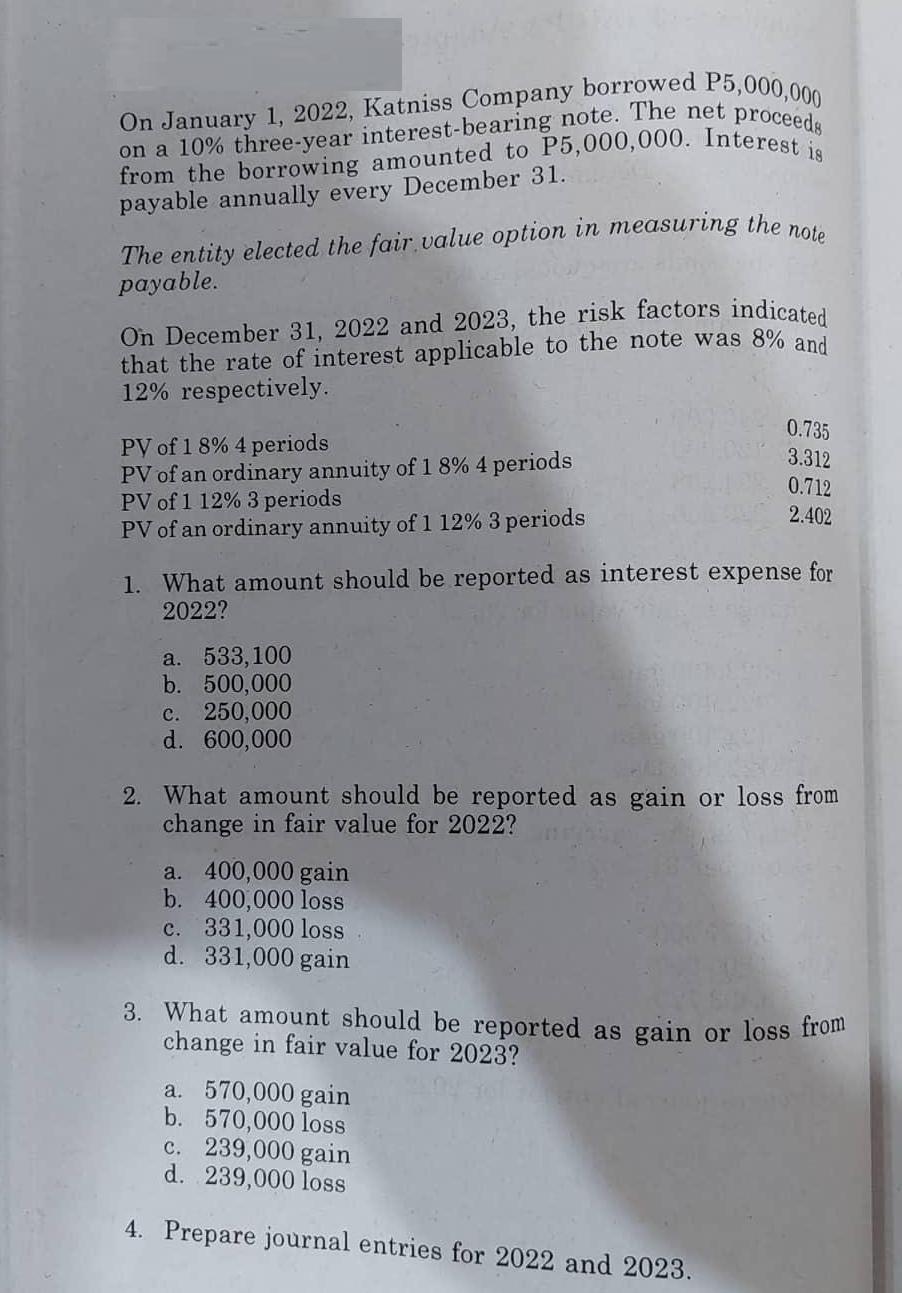

On January 1, 2022, Katniss Company borrowed P5,000,000 on a 10% three-year interest-bearing note. The net proceeds from the borrowing amounted to P5,000,000. Interest is payable annually every December 31. note The entity elected the fair value option in measuring the payable. On December 31, 2022 and 2023, the risk factors indicated that the rate of interest applicable to the note was 8% and 12% respectively. PV of 1 8% 4 periods PV of an ordinary annuity of 1 8% 4 periods PV of 1 12% 3 periods PV of an ordinary annuity of 1 12% 3 periods 1. What amount should be reported as interest expense for 2022? a. 533,100 b. 500,000 c. 250,000 d. 600,000 2. What amount should be reported as gain or loss from change in fair value for 2022? a. 400,000 gain b. 400,000 loss c. 331,000 loss d. 331,000 gain 0.735 3.312 0.712 2.402 3. What amount should be reported as gain or loss from change in fair value for 2023? a. 570,000 gain b. 570,000 loss c. 239,000 gain d. 239,000 loss 4. Prepare journal entries for 2022 and 2023.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 What amount should be reported as int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started