Answered step by step

Verified Expert Solution

Question

1 Approved Answer

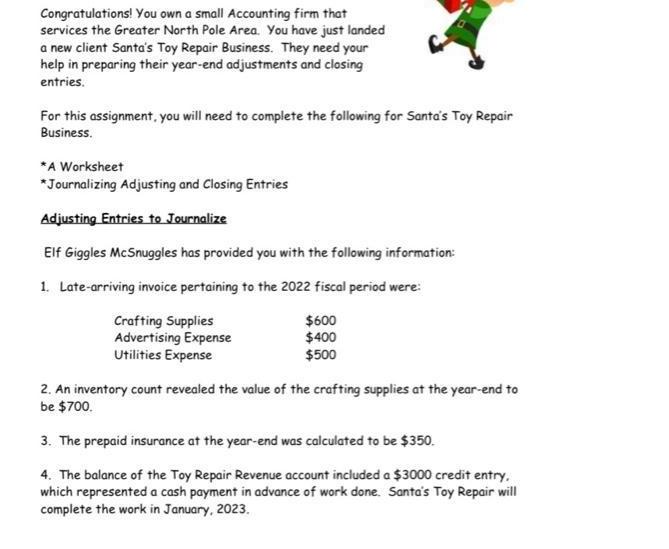

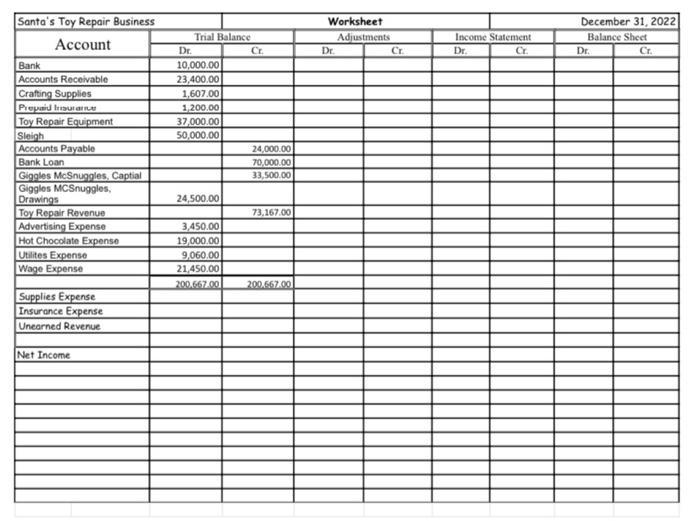

Congratulations! You own a small Accounting firm that services the Greater North Pole Area. You have just landed a new client Santa's Toy Repair

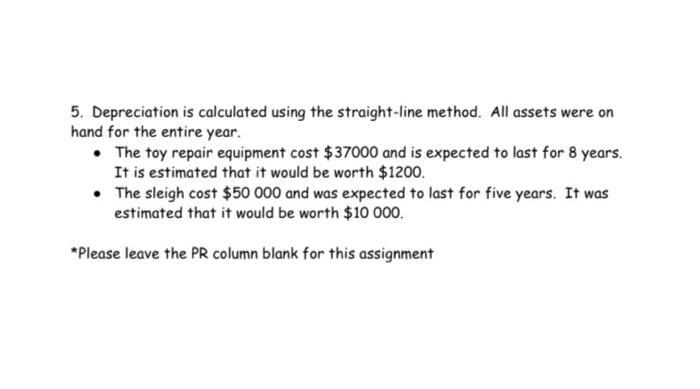

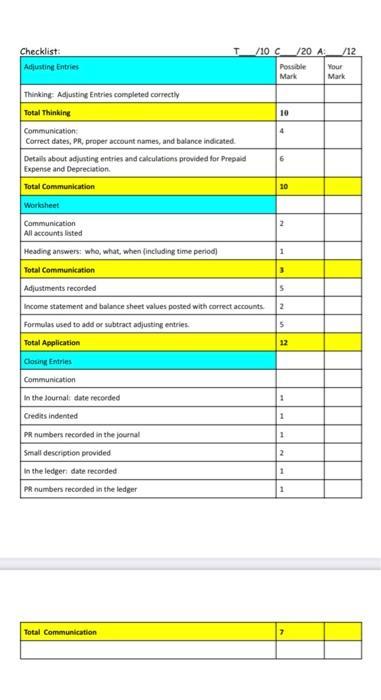

Congratulations! You own a small Accounting firm that services the Greater North Pole Area. You have just landed a new client Santa's Toy Repair Business. They need your help in preparing their year-end adjustments and closing entries. For this assignment, you will need to complete the following for Santa's Toy Repair Business. *A Worksheet *Journalizing Adjusting and Closing Entries Adjusting Entries to Journalize Elf Giggles McSnuggles has provided you with the following information: 1. Late-arriving invoice pertaining to the 2022 fiscal period were: $600 $400 $500 Crafting Supplies Advertising Expense Utilities Expense 2. An inventory count revealed the value of the crafting supplies at the year-end to be $700. 3. The prepaid insurance at the year-end was calculated to be $350. 4. The balance of the Toy Repair Revenue account included a $3000 credit entry. which represented a cash payment in advance of work done. Santa's Toy Repair will complete the work in January, 2023. 5. Depreciation is calculated using the straight-line method. All assets were on hand for the entire year. The toy repair equipment cost $37000 and is expected to last for 8 years. It is estimated that it would be worth $1200. The sleigh cost $50 000 and was expected to last for five years. It was estimated that it would be worth $10 000. *Please leave the PR column blank for this assignment Checklist: Adjusting Entries Thinking: Adjusting Entries completed correctly Total Thinking Communication Correct dates, PR, proper account names, and balance indicated. Details about adjusting entries and calculations provided for Prepaid Expense and Depreciation. Total Communication Worksheet Communication All accounts listed Heading answers: who, what, when (including time period) Total Communication T /10 C Adjustments recorded Income statement and balance sheet values posted with correct accounts. Formulas used to add or subtract adjusting entries. Total Application Closing Entries Communication In the Journal: date recorded Credits indented PR numbers recorded in the journal Small description provided In the ledger: date recorded PR numbers recorded in the ledger Total Communication Possible Your Mark Mark 10 4 6 10 2 1 3 S 2 5 12 1 1 2 1 /20 A /12 1 Santa's Toy Repair Business Account Bank Accounts Receivable Crafting Supplies Prepaid Insurance Toy Repair Equipment Sleigh Accounts Payable Bank Loan Giggles McSnuggles, Captial Giggles MCSnuggles, Drawings Toy Repair Revenue Advertising Expense Hot Chocolate Expense Utilites Expense Wage Expense Supplies Expense Insurance Expense Unearned Revenue Net Income Trial Balance Dr. 10,000.00 23,400.00 1,607.00 1,200.00 37,000.00 50,000.00 24,500.00 3,450.00 19,000.00 9,060,00 21,450.00 200.667.00 Cr. 24,000.00 70,000.00 33,500.00 73.167.00 200.667.00 Worksheet Dr. Adjustments Cr. Income Statement Dr. Cr. December 31, 2022 Balance Sheet Dr. Cr. GENERAL JOURNAL DATE DESCRIPTION PR PAGE DEBIT 101 CREDIT

Step by Step Solution

★★★★★

3.59 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started