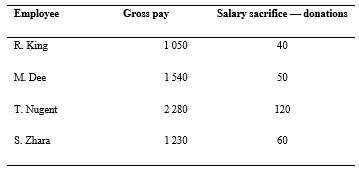

The following information is used to calculate Interior Trader Ltds payroll for the week ending 30 June

Question:

The following information is used to calculate Interior Trader Ltd’s payroll for the week ending 30 June 2024.

Employees’ superannuation contribution is 10% of their gross pay. PAYG tax is taken out at 24% after subtracting the donations and superannuation. All employees also have the following deductions from their after‐tax pay: 3.5% life insurance and 12% medical insurance.

Required

(a) Calculate ‘take‐home’ pay for each employee.

(b) Prepare a general journal entry to accrue the payroll and associated deductions.

(c) Prepare a cash payments journal entry to record the payment of wages.

(d) Assume that, on 6 July 2024, the company forwarded a payment to cover amounts withheld from employees’ wages for the month of June. Total income tax deductions were $5 740. Other deduction liabilities were four times the total weekly deductions. Prepare a cash payments journal entry to record these payments.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie