The following information was available from records and the bank statement of Baldacchino Services Ltd, on 31

Question:

The following information was available from records and the bank statement of Baldacchino Services Ltd, on 31 May.

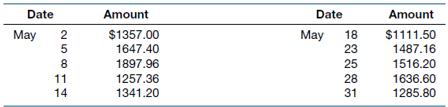

The date and the amount of each deposit as recorded during May were as follows.

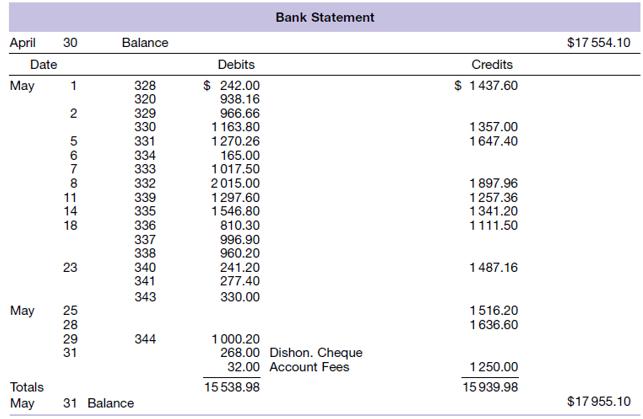

On 31 May, the bank debited the account for \($268.00\) for a customer cheque (deposited in April) returned because of insufficient funds, and for \($32.00\) for account fees. On 31 May, the bank also credited the account for \($1250.00\) for the proceeds of a non-interest-bearing note receivable that it had collected on behalf of the company.

Outstanding cheques at the last statement date, 30 April, were: no. 320 for \($938.16\), no. 328 for \($242.00\), and no. 326 for $813.00; outstanding deposits were $1437.60.

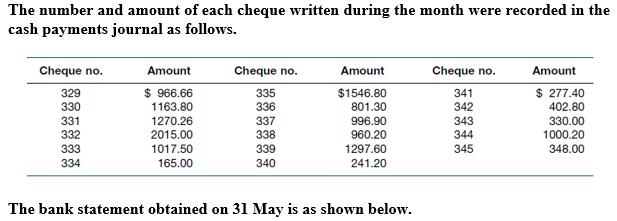

The accountant discovered that cheque no. 336 (in payment for the purchase of office equipment) was correctly issued for \($810.30\) but incorrectly recorded in the cash payments journal as $801.30.

The balance in the Cash at Bank account in the company’s records on 1 May was \($16\) 998.54.

Required

(a) Complete the cash journals and post the totals to the Cash at Bank account. Show the Cash at Bank account (T-account form) after it had been balanced on 31 May.

(b) Prepare a bank reconciliation statement as at 31 May.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie