Alexon Ltd is a company selling bicycles. The directions have an overdraft facility of $30,000, but are

Question:

Alexon Ltd is a company selling bicycles. The directions have an overdraft facility of $30,000, but are concerned about liquidity and wish to prepare a cash budget for the three months ending 30 June 2016.

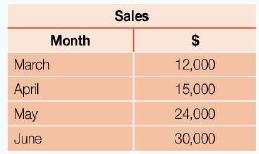

The directors provide the following information.

Additional information:

Thirty per cent of all sales are on a cash basis with payment received immediately. The remaining 70 per cent of sales are on one-month credit terms. The company offers 5 per cent discount to credit customers and expects all amounts to be received on time.

• Purchases represent 40 per cent of the sales price and suppliers are paid one month in arrears. Purchases are made in the same month in which they are sold.

• Operating expenses are expected to be $2500 per month (including depreciation of $400) and are paid in the month incurred.

• Directors' salaries total $6000 per month.

• In May, the company must pay a tax bill of $12,000 and has agreed to purchase non-current assets at a price of $8000.

• On 1 June the directors plan to issue 10 000 ordinary shares of $1 each at a premium of $50. This will increase the issued share capital to $50,000. The directors expect the share issue to be fully subscribed.

• The directors propose to pay an interim dividend of 150 per share on 30 June to all shareholders of ordinary shares on that date.

• The balance on the company's bank account at 1 April is expected to be $18,700 overdrawn.

Required

a. Prepare a cash budget for each of the three months ending 30 June 2016.

b. Advise the directors what steps could be taken to improve the company's liquidity.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone