Gaynor, Henry and Irvin are in partnership, sharing profits and losses as follows: Gaynor 20 percent; Henry

Question:

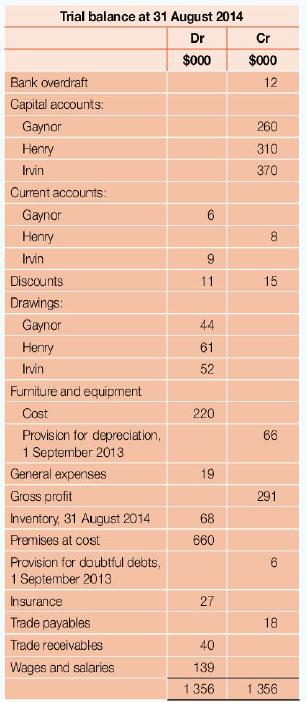

Gaynor, Henry and Irvin are in partnership, sharing profits and losses as follows: Gaynor 20 percent; Henry 40 percent; Irvin 40 percent. The following trial balance was extracted from the business's books of account on 31 August 2014, the last day of the partnership's financial year.

Additional information:

• Insurance: $3000 was prepaid at 31 August 2014.

• Wages and salaries due but unpaid totaled $12 000 at 31 August 2014.

• Depreciation should be provided on furniture and fittings at 20 percent per annum using the straight-line method.

• The provision for doubtful debts should be maintained at 5 percent of trade receivables. The partnership agreement includes the following terms:

• Interest should be charged on drawings. Interest charged on drawings for the year ended 31 August 2014 was: Gaynor $4000, Henry $5000, Irvin $7000.

• Gaynor is entitled to receive a partnership salary of $28,000 per annum.

• Partners are entitled to receive interest on capitals at the rate of 10 percent.

Prepare:

a. An income statement for the year ended 31 August 2014

b. An appropriation account for the year ended 31 August 2014

c. Partners' current accounts for the year ended 31 August 2014

d. A statement of financial position at 31 August 2014; this should show only the balances on the partners' current accounts at this date.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone