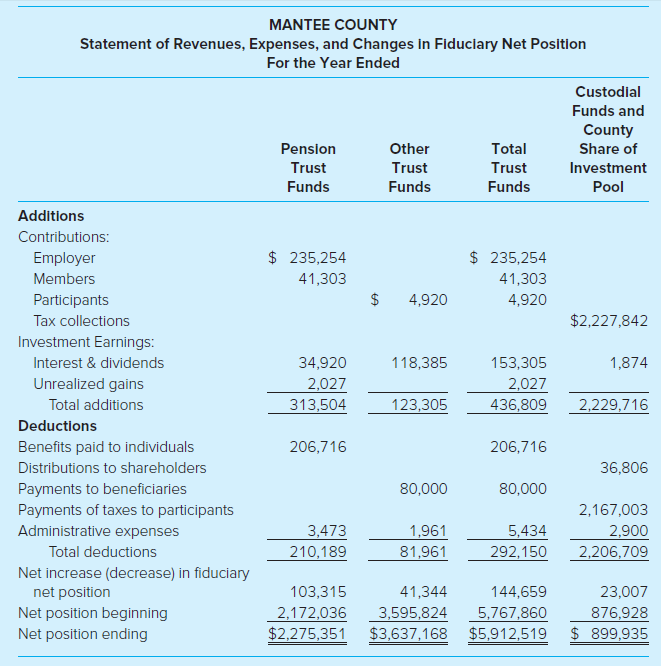

Mantee County administers a pension fund and a post retirement benefits fund for some of its workers,

Question:

Required

This is the first time Mantee County has prepared its operating statement for the fiduciary funds under the GASBS 84 requirements. However, it does not appear to be in conformance with the new standard. Identify the errors in the statement and explain how the errors can be corrected.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely

Question Posted: