SlowRider Inc. had a rudimentary business intelligence (BI) system. Analysts at SlowRider Inc. pulled data from three

Question:

SlowRider established a project team to look at acquiring a state-of-the-art business intelligence system. After several interviews with all the managers, the project team was ready to develop the business case.

The project team estimated benefits of the new BI system as follows:

€¢ 5 percent increase in sales through better-focused sales campaigns, which should

increase gross margins by $200,000 in year 1 and $300,000 in years 2 and 3.

€¢ 10 percent increase in inventory turnover through better purchasing, which should

reduce inventory carrying costs by $100,000 in year 1 and $150,000 in years 2 and 3.

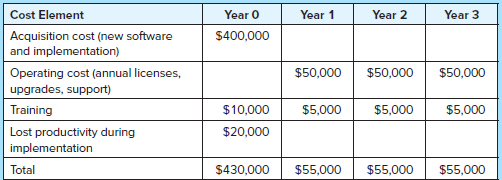

The project team estimated costs over an expected 3-year life as follows:

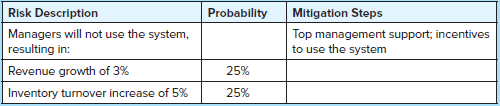

After interviewing managers at other firms that have already implemented similar BI systems, the project team then estimated that the initiative would have the following risks.

a. Disregarding the risk, calculate the following for the BI investment:

1. The payback period

2. The NPV (assume 10 percent discount rate)

3. The IRR

4. The accounting rate of return

b. Recalculate the payback period, NPV, IRR, and ARR considering the risk.

c. Prepare a value proposition for the BI investment. Should SlowRider pursue the investment? What other issues should they consider?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Information Systems

ISBN: 978-1260153156

2nd edition

Authors: Vernon Richardson, Chengyee Chang, Rod Smith

Question Posted: