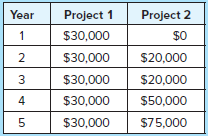

Sunset Graphics is considering two mutually exclusive projects. Both require an initial investment of $100,000. Assume a

Question:

a. Compute the NPV, payback, and IRR for both projects. Which is more desirable?

b. Assume straight-line depreciation is used for both projects; compute the accounting rate of return. What do you think of the ARR criterion?

c. Assume a change in interest rate to 15 percent. Does that change your views on which project the company should adopt?

d. Assume a change in interest rate to 6 percent. Does that change your views on which project the company should adopt?

e. For investments in technology, which cash inflow projection is most likely?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Information Systems

ISBN: 978-1260153156

2nd edition

Authors: Vernon Richardson, Chengyee Chang, Rod Smith

Question Posted: