Task: Create a depreciation schedule to monitor your companys investment in fixed assets. a. Your spreadsheet should

Question:

Task: Create a depreciation schedule to monitor your company’s investment in fixed assets.

a. Your spreadsheet should have the following column headings:

• Account number (5 digits, valid range from 11000 to 19999)

• Description (text, valid entries = software, laptop, monitor, workstation, desk, chair)

• Date placed in service (mm/dd/yyyy format)

• Estimated useful life

• Acquisition cost

• Beginning accumulated depreciation (prior to this year)

• Current period depreciation (straight-line method, assume no salvage value)

• Ending accumulated depreciation (beginning accumulated depreciation plus current period depreciation)

• Net book value (acquisition cost-ending accumulated depreciation)

b. In the top rows of the spreadsheet, enter the following data:

• Your name (in row 1)

• Depreciation schedule for year (in row 2)

• Two cells to the right of the text “Depreciation schedule for year,” a formula that returns the current year (i.e., if the date is 10/31/2009 your formula should return the value 2009)

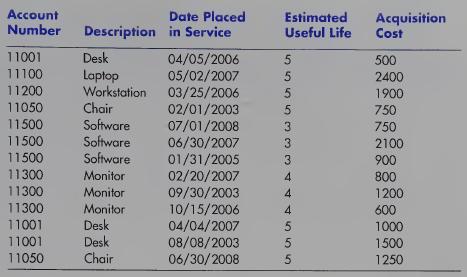

c. Enter the following data:

d. Create formulas to calculate the beginning balance of accumulated deprecia¬ tion, current depreciation, ending balance, and net book value.

• Use the built-in Year(xxx) function to return the year portion of a date in mm/dd/yyyy format.

• The today0 takes no arguments and returns the current date in mm/dd/yyyy format.

• Assume that assets placed in service anytime during a year can be depreci¬ ated for the entire year.

e. Include the following validation checks, with appropriate and informative error messages should any of these be violated:

• Each entry in the columns account number, description, and date contains allowable values.

• If an asset has already been fully depreciated, current depreciation should be zero.

• Ending balance of accumulated depreciation should equal beginning bal¬ ance plus current depreciation.

• Net book value should equal acquisition cost minus ending balance of accu¬ mulated depreciation.

• The sum of all net book values should equal the sum of all acquisition costs minus the sum of all ending balances of accumulated depreciation.

f. Create a table at the bottom of your worksheet that consists of two columns:

• Asset name (values should be chair, desk, laptop, monitor, software, and workstation)

• New book value (use as a built-in Excel function to calculate this number)

Step by Step Answer: