The management of Pink Ltd is worried because the bank overdraft has increased by a substantial amount

Question:

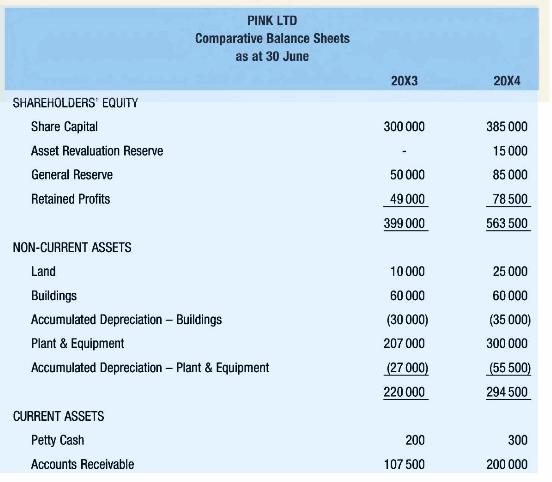

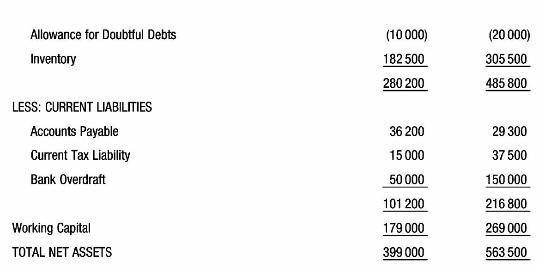

The management of Pink Ltd is worried because the bank overdraft has increased by a substantial amount over the financial year ended 30 June 20X4 despite a large profit and the introduction of additional capital. The Balance Sheets as at 30 June 20X3 and 20X4 were as follows:

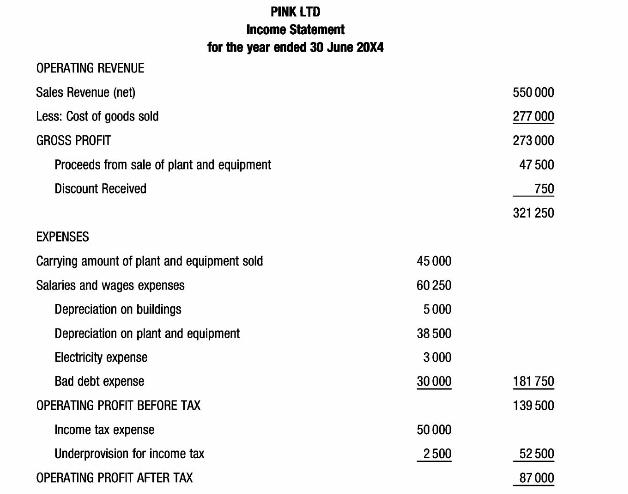

The internal income statement for the year ended 30 June 20X4 prepared for management purposes, showed the following details:

Additional information • The land was revalued upwards during the year by \(\$ 15000\).

• During the year, a dividend of \(\$ 22500\) had been paid.

• Plant and equipment which had originally cost \(\$ 55000\) and had been depreciated by \(\$ 10000\) was sold during the year for \(\$ 47500\).

• The likely tax payable for the years ended 30 June 20X3 and 20X4 were \(\$ 20000\) and \(\$ 50000\), respectively.

• For the year ended 30 June 20X3, the ATO issued an amended assessment of \(\$ 22500\) resulting in an underprovision of \(\$ 2500\) being recorded in 20X8.

Required:

Prepare a cash flow statement as per AASB 107 including all relevant notes.

Step by Step Answer:

Accounting Information For Business Decisions

ISBN: 9780170253703

2nd Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh, Geoff Slaughter, Sharelle Simmons