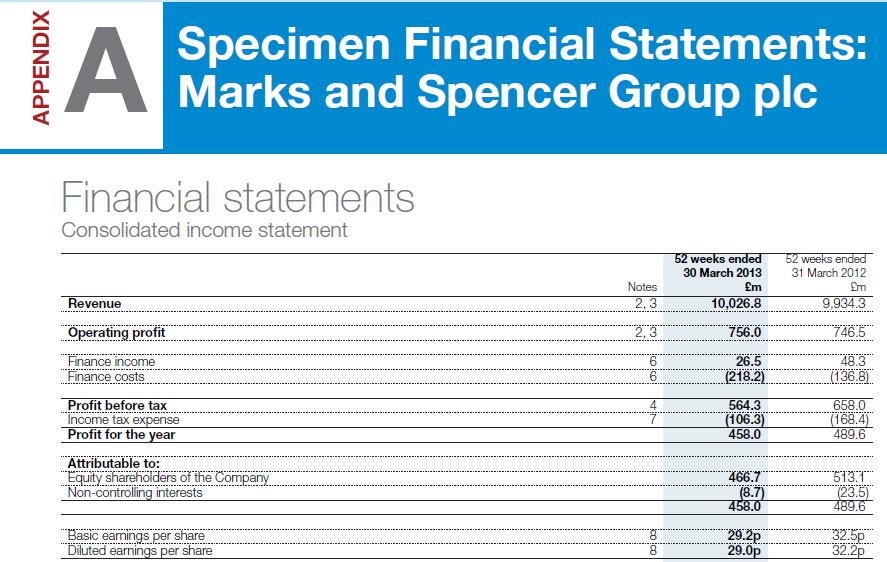

Intermediate Accounting IFRS Edition 2nd Edition Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield - Solutions

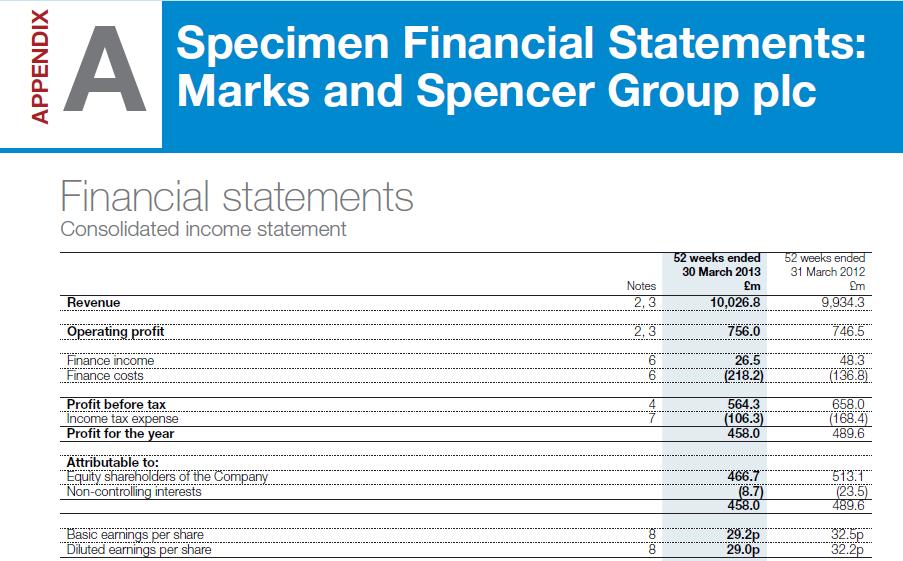

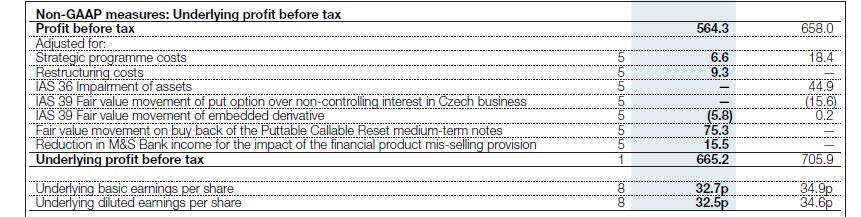

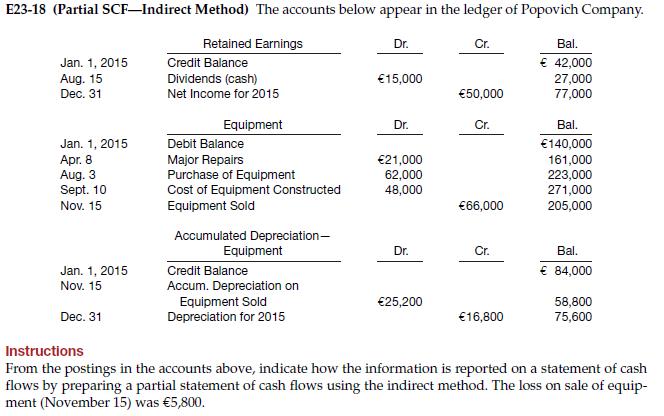

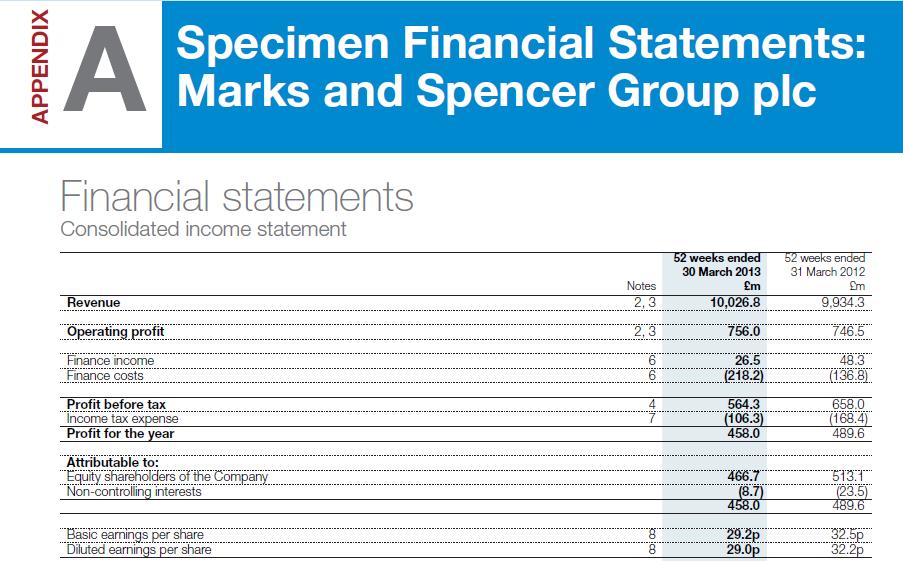

Unlock the full potential of your accounting studies with our comprehensive resources for "Intermediate Accounting IFRS Edition 2nd Edition" by Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield. Access a wealth of online answers key, solutions manual, and solutions in PDF format, tailored to meet your learning needs. Dive into expertly solved problems, detailed questions and answers, and an extensive test bank for thorough preparation. Explore chapter solutions and step-by-step answers crafted for deep understanding. Utilize our instructor manual and textbook resources for enhanced learning. Discover the convenience of free download options to support your academic journey effortlessly.

![]()

![]() New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

![]()

![]()