Assume that Sarazan Company has a share-option plan for top management. Each share option represents the right

Question:

Assume that Sarazan Company has a share-option plan for top management.

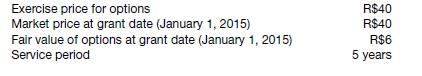

Each share option represents the right to purchase a R$1 par value ordinary share in the future at a price equal to the fair value of the shares at the date of the grant. Sarazan has 5,000 share options outstanding, which were granted at the beginning of 2015. The following data relate to the option grant.

Instructions

(a) Prepare the journal entry(ies) for the first year of the share-option plan.

(b) Prepare the journal entry(ies) for the first year of the plan assuming that, rather than options, 700 shares of restricted shares were granted at the beginning of 2015.

(c) Now assume that the market price of Sarazan shares on the grant date was R$45 per share. Repeat the requirements for

(a) and (b).

(d) Sarazan would like to implement an employee share-purchase plan for rank-and-file employees, but it would like to avoid recording expense related to this plan. Explain how employee sharepurchase plans are recorded.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield