Wasim Raine owns and operates a printery service called Raine's Paper and Office. It is the end

Question:

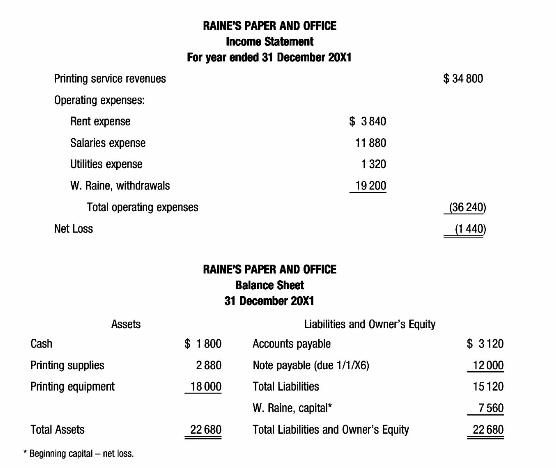

Wasim Raine owns and operates a printery service called Raine's Paper and Office. It is the end of the year, and his bookkeeper has resigned. Knowing only a little about accounting, Wasim prepared the following financial statements based on the ending balances in the business' accounts on 31 December 20X1.

Wasim is upset and says to you, 'I don't know how I could have had a net loss in 20X1. Maybe I did something wrong when I made out these financial statements. Could you help me?

My business has been good in 20X1. People have been getting their copy and other items printed by me instead of buying new ones. I used to rent my printing equipment, but business was so good that I purchased \(\$ 18000\) of printing equipment at the beginning of the year. I know this equipment will last 10 years, even though it won't be worth anything at the end of that time. I did have to sign a note for \(\$ 12000\) of the purchase price, but the amount (plus \(\$ 1440\) annual interest) will not be due until the beginning of 20X4. I still have to rent my printery but I paid \(\$ 3840\) for two years of rent in advance at the beginning of 20X1. Besides, I just counted my printing supplies and I have \(\$ 1320\) of supplies left from \(20 \mathrm{X} 1\) which I can use in 20X2.'

He continues: 'I'm not too worried about my cash balance. I know that customers owe me \(\$ 840\) for printing I completed in 20X1. These are good customers and always pay, but I never tell my bookkeeper about this until I collect the cash. I am sure I will collect in 20X2, and that will also make 20X2 revenues look good. In fact, it will almost offset the \(\$ 720\) I just collected in advance (and recorded as a revenue) from a customer for printing I will do in 20X2. I still have to write a cheque to pay my bookkeeper for his last month's salary, but he was my only employee in 20X1. In 20X2 I am going to hire someone only on a part-time basis to keep my accounting records. You can have the job if you can determine whether the net loss is correct and, if not, what it should be and what I am doing wrong.'

Required:

a Set up the following account columns: under Assets: Accounts Receivable, Printing Supplies, Prepaid Rent and Printing Equipment; under Liabilities: Unearned Revenues, Salaries Payable and Notes Payable; under Owner's Equity (Revenues): Printing Service Revenues; and under Expenses: Depreciation Expense, Interest Expense, Rent Expense, Supplies Expense, and Salaries Expense. Enter any balances for these accounts shown on the financial statements.

b Using the accounts from (a), prepare any year-end adjustments you think are appropriate for 20X1. Show any supporting calculations. Calculate the ending balance of each account.

c Prepare a corrected 20Xl income statement, statement of changes in owner's equity and ending classified balance sheet (report form).

d Write a brief report to Wasim Raine summarising your suggestions for improving his accounting practices.

Step by Step Answer:

Accounting Information For Business Decisions

ISBN: 9780170253703

2nd Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh, Geoff Slaughter, Sharelle Simmons