Ballamauda Ltd During the year ending 31 December year 2 a. A machine, which had originally cost

Question:

Ballamauda Ltd

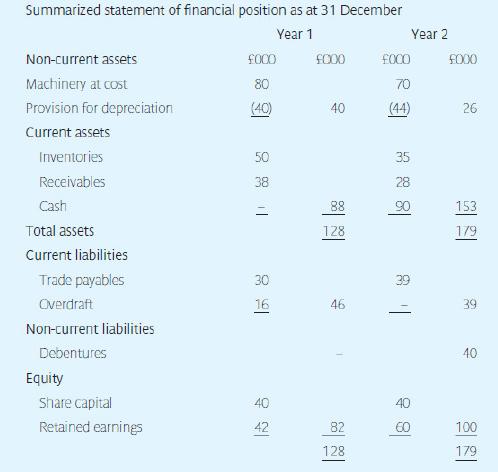

During the year ending 31 December year 2

a. A machine, which had originally cost £10,000, and on which £6,000 depreciation had been charged, was sold for £3,400.

b. The profit before tax, after deducting the loss on the sale of the machine, was £35,200.

c. Interest of £2,400, taxation of £6,400 and dividends of £6,000 were paid.

You are required to produce a cash flow statement for Ballamauda Ltd for the year ended 31 December year 2.

Transcribed Image Text:

Summarized statement of financial position as at 31 December Year 1 Year 2 Non-current assets 000 000 000 000 Machinery at cost 80 70 Provision for depreciation (40) 40 (44) 26 Current assets Inventories Receivables Cash 50 35 38 28 88 90 153 128 179 Total assets Current liabilities Trade payables 30 99 Overdraft 16 46 39 Non-current liabilities Debentures 40 Equity Share capital 40 Retained earnings 16 40 42 82 60 100 128 179

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (2 reviews)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Consider a deck of 52 cards. You randomly pick a card. Let A denote the event that the card is a King and B denote the event that the card is from the suits Hearts or Diamonds. Are the events A and B...

-

(a) ABC is a company that manufactures computer desk. The total costs (in RM'000) when x units of computer desk are produced is given by C(x) = 12x 3 - 198x 2 + 1080x Find the level of x that the...

-

Given the information provided in Fig. 4.113, determine: (a) RC. (b) RE. (c) RB. (d) VCE. (e) VB. 12 V 2 mA Rc 7.6 V 24 V

-

Jamil Jonas is an accountant in public practice as a sole propreitor. Not long ago, Jamil struck a deal with his neighbour Ralph to prepare Ralphs business income tax and GST returns for 2020 in...

-

If competition causes all companies to have similar ROEs in the long run, would companies with high turnovers tend to have high or low profit margins? Explain your answer. AppendixLO1

-

The following accounts and balances were drawn from the records of Barker Company at December 31, 2018: Required Use the accounts and balances from Barker Company to construct an income statement,...

-

Current Attempt in Progress Quest 6 Que Blossom Ltd. had the following share transactions during its first year of operations Jan. Issued 240.000 common shares for $1.50 per share. Jan. 12 Issued...

-

A car traveling at 5.0 m/s speeds up to 10 m/s, with an increase in kinetic energy that requires work W1. Then the cars speed increases from 10 to 15 m/s, requiring additional work W2. Which of the...

-

The trial balance of Faraway Retailers Ltd as at 31 December year 1 is shown below. Additional information a The stocktake on 31 December year 1 revealed the following: b Rent and rates includes a...

-

Draw a block diagram for the following equation. The output is X(s) the inputs are F(s) and G(s). 5x + 3 x + 7x = 10/(0 4g(f)

-

As the human resource manager, how would you evaluate the training needs of your staff? How can you ensure that the training you would provide is effective? What data might be used to make your...

-

MARYLAND CORPORATION manufactures three liquid products - Alpha, Beta and Gamma using a joint process with direct materials, direct labor and overhead totaling $560,000 per batch. In addition, the...

-

Three common organizational structures. Mention one organization for each organizational structure which is following a specific organizational structure. Also, provide support to your answer by...

-

You are a retail manager at Kitchen Nightmare, a relatively new store at the mall that sells mostly items for kitchens, like forks, oven mitts, etc.. You have been open since the fall of 2021 and...

-

Examine the extent to which the Department of Veteran Affairs has established any processes or procedures to ensure knowledge retention of departing employees. Why is it important to manage the...

-

Suppose in our two-period model of the economy that the government, instead of borrowing in the current period, runs a government loan program. That is, loans are made to consumers at the market real...

-

Swifty company is a publicly held corporation whose $1 par value stock is actively traded at $30 per share. The company issued 3400 shares of stock to acquire land recently advertised at $93000. When...

-

question 6 Timely Inc. produces luxury bags. The budgeted sales and production for the next three months are as follows july. august september Sales, in units 1,115. 1229. 1302 Production. in units...

-

On May 12 Zimmer Corporation placed in service equipment (seven-year property) with a basis of $220,000. This was Zimmer's only asset acquired during the year. Calculate the maximum depreciation...

-

Power Manufacturing has equipment that it purchased 7 years ago for $2,550,000. The equipment was used for a project that was intended to last for 9 years and was being depreciated over the life of...

Study smarter with the SolutionInn App