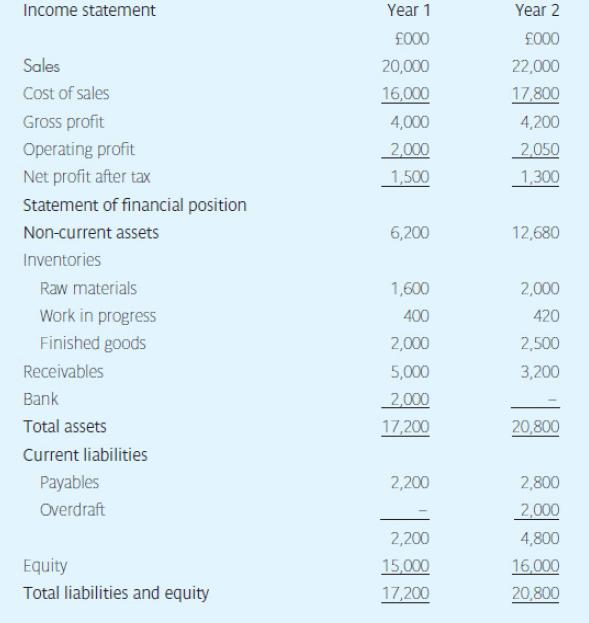

The following information has been extracted from the most recent annual report and accounts of Greyhound Leather

Question:

The following information has been extracted from the most recent annual report and accounts of Greyhound Leather Manufacturers Ltd:

a The finance director is pleased with the management of working capital, but the chairman is more concerned about profitability.

Making use of appropriate calculations, you are required to analyse the financial management of the company and comment on the two points of view expressed.

b What is meant by the working capital cycle? Illustrate your answer with appropriate calculations for Greyhound Leather Manufacturers Ltd.

c What steps can a company take to improve inventory turnover?

d The company uses one million hides of leather a year, which it buys for £16 each. Stockholding costs are estimated to be 25 per cent per annum of the cost of the items in inventory.

Administration costs for placing and receiving an order are estimated to be £50. How many hides should the company order at a time (i.e. calculate the EOQ)?

e Illustrate the financial effects of implementing the EOQ in practice and suggest its limitations.

Step by Step Answer: