The Peel Company is considering two alternative investment opportunities: a Kippering Project and a Queenies Project. Each

Question:

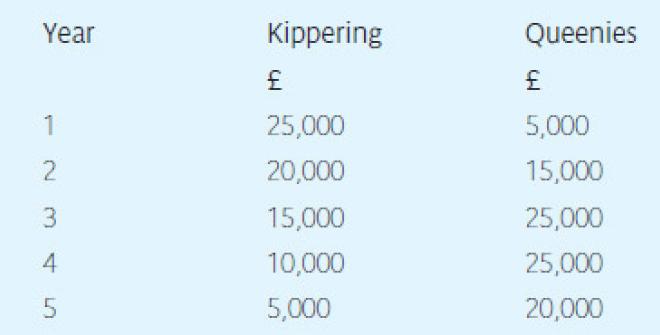

The Peel Company is considering two alternative investment opportunities: a Kippering Project and a Queenies Project. Each would involve an initial outlay of £50,000 and is expected to have a five-year life with no scrap value at the end. The additional cash flows (before deducting depreciation) that each project is expected to generate are as follows:

You are required to calculate the following for each project, and suggest how a decision should be made between the two projects:

a. average annual profits;

b. return on initial capital employed;

c. return on average capital employed;

d. payback period;

e. NPV using 10 per cent discount factor;

f. NPV using 25 per cent discount factor;

g. an approximate internal rate of return.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: