The Maroc Production Company is considering manufacturing and selling an economy video camera for use by small

Question:

The Maroc Production Company is considering manufacturing and selling an economy video camera for use by small retailers for security purposes. A firm of management consultants has carried out a feasibility study for them at a cost of £25,000, which has not yet been paid. There would be two requirements for machinery:

a Some existing machinery could be modified at a cost of £100,000 to undertake the first stage of production.

b For the second stage of production the company already has suitable machinery that is not in use; it has a book value of £80,000; it would be difficult to dismantle and dispose of, and its net realizable value at present is zero.

If the project goes ahead, maintenance costs of the machinery would be £10,000 per annum; there would be additional working capital requirements of £50,000 at the beginning of the project, which would be recovered at the end of four years; initial marketing costs, to be paid for as soon as soon as the project is approved would be £60,000; and annual marketing costs would be £20,000 per annum for the full four years.

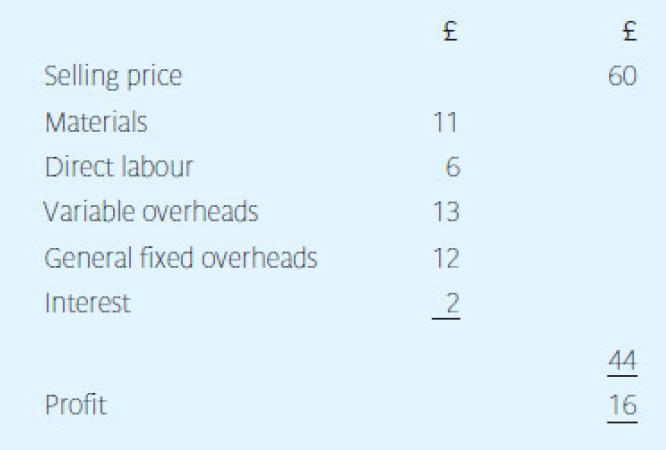

The cost and selling price per unit is expected to be:

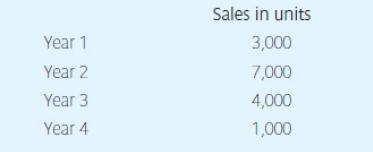

The management consultants have suggested that the product would have a four-year life before being superseded by better cameras, and that the pattern of sales would be:

The company’s cost of capital is assumed to be 20 per cent per annum.

Making careful use of the above information, calculate the NPV of the project. Ignore taxation. Make and state appropriate assumptions where necessary.

Step by Step Answer: