The trial balance of Brad Head as at 31 December year 3 was as follows: Adjustments a.

Question:

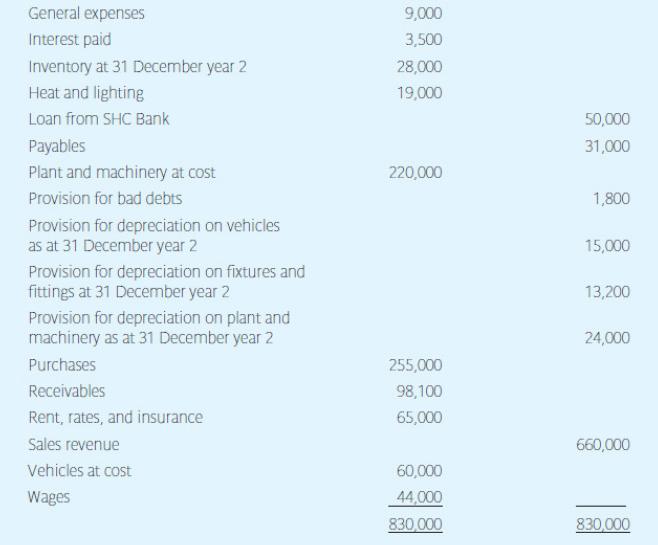

The trial balance of Brad Head as at 31 December year 3 was as follows:

Adjustments

a. Closing inventory as at 31 December year 3 amounted to

£13,000.

b. Depreciation is to be provided on plant and machinery on a straight-line basis at 10 per cent per annum.

c. Depreciation is to be provided on fixtures and fittings on a straight-line basis at 10 per cent per annum.

d. Depreciation is to be provided on the delivery van at 20 per cent per annum on a diminishing balance basis.

e. An electricity bill for the three months ending on 31 January year 4 amounts to £3,000 and has not yet been recorded in the accounts.

f. Rent for the three months ending on 28 February year 4, amounting to £6,600, was paid at the beginning of December year 3.

g. A specific debt of £2,100 is to be written off as irrecoverable.

h The provision for bad debts is to be adjusted to be 2.5 per cent of debtors.

i. On 31 December year 3 Brad Head took drawings from the business of £6,000, which have not yet been recorded.

Prepare an income statement for the year ended 31 December year 3, and a statement of financial position as at that date.

Step by Step Answer: