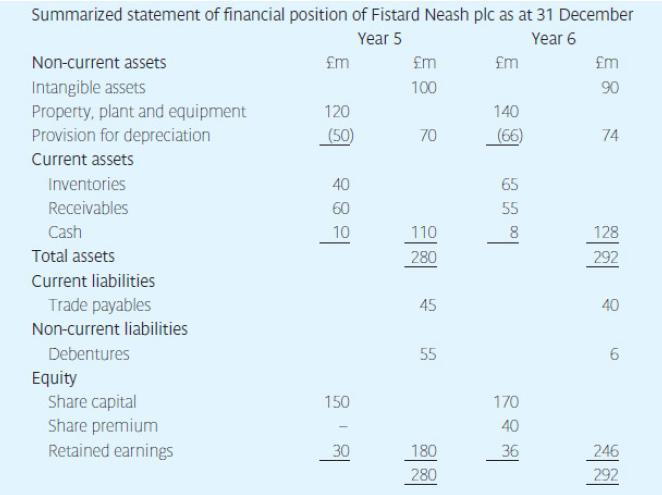

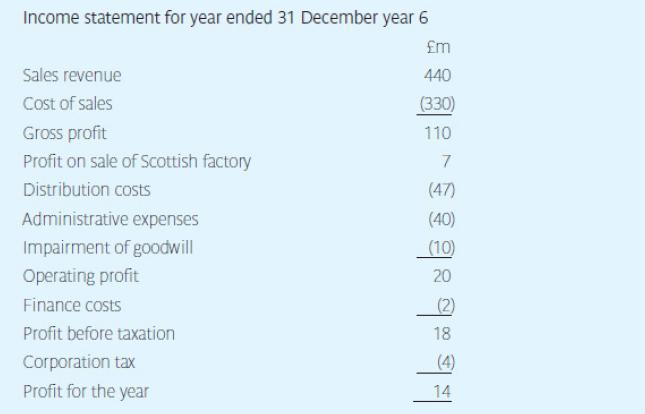

You are required to prepare a cash flow statement for Fistard Neash plc for the year ended

Question:

You are required to prepare a cash flow statement for Fistard Neash plc for the year ended 31 December Year 6

During the year ending 31 December year 6 a The Scottish factory had originally cost £24m, and depreciation of £8m had been charged on it. It was sold for £23m.

b Dividends paid were £8m.

c Interest of £2m and taxation of £4m were paid.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: