Question: Question 1 This question has two parts, (A) and (B). Answer both parts. 100% Liverpool plc is a company that manufactures a number of different

Question 1

This question has two parts, (A) and (B). Answer both parts. 100%

Liverpool plc is a company that manufactures a number of different types of electrical goods and has a year end of 31 March. Liverpool plc acquired 75% of the ordinary share capital of Manchester Limited on 1 April 2013 for £840,000. On the date of acquisition the balance on the retained earnings reserve of Manchester Limited was £300,000 and the ordinary share capital of Manchester Limited was £760,000. The goodwill arising on the acquisition of Manchester Limited has been fully impaired by 31 March 2019.

Liverpool plc formed a joint venture in 2010 with another company. The joint venture is called Sheffield Limited, and Liverpool plc has a 50:50 share with the other company in the joint venture. The ordinary share capital of Sheffield Limited consisted of 90,000 ordinary shares of £1 each.

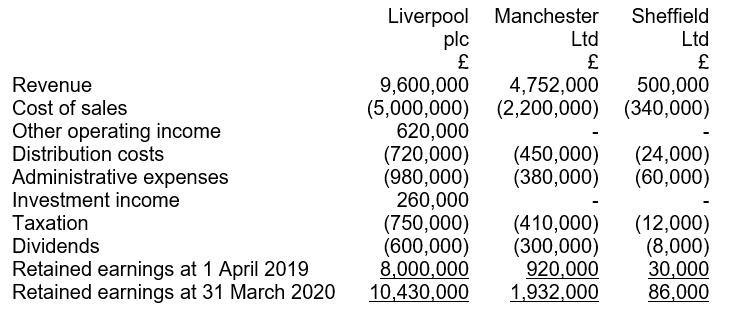

The draft income statements of Liverpool plc, Manchester Limited and Sheffield Limited for the year ended 31 March 2020 were as follows:

…Question 1 continued…

The following additional information is available.

- On 1 May 2019, Liverpool plc sold goods to Manchester Limited for £400,000, which had an original cost to Liverpool plc of £300,000. Manchester Limited sold all of these goods to third parties in August 2019 for £480,000.

- On 31 January 2020, Manchester Limited sold goods to Liverpool plc for £200,000, which had an original cost to Manchester Limited of £180,000. On 31 March 2020, none of these goods had been sold by Liverpool plc to third parties.

- The other operating income of Liverpool plc includes £100,000 charged to Manchester Limited for carrying out accounting services on their behalf. This charge is included in Manchester Limited’s administrative expenses. The remaining other operating income of Liverpool plc arises from companies outside of the Liverpool Group plc.

REQUIRED

- Prepare the Consolidated Statement of Comprehensive Income of the Liverpool Group plc for the year ended 31 March 2020. (78%)

- Calculate the balance on the consolidated retained earnings reserve of the Liverpool Group plc at 31 March 2020. (22%)

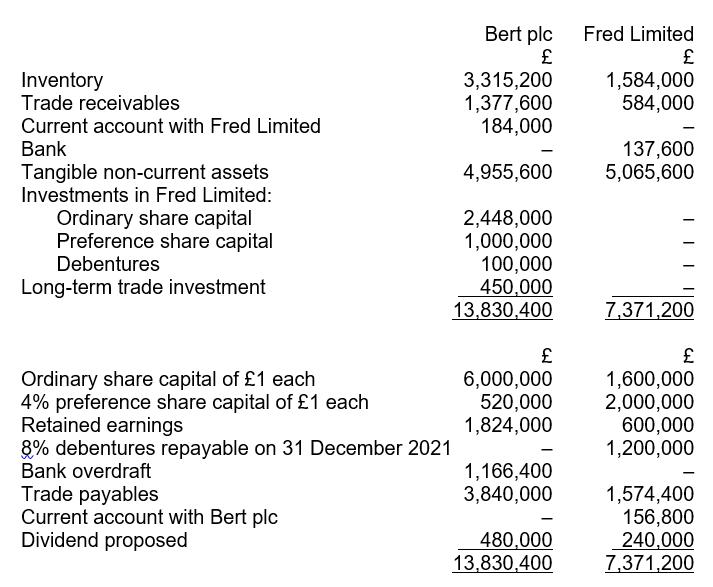

Bert plc acquired 75% of the ordinary share capital of Fred Limited on 1 January 2018, when the balance on the retained earnings reserve of Fred Limited was £500,000. Bert plc also acquired 40% of the preference share capital of Fred Limited on 1 January 2019, when the balance on the retained earnings reserve of Fred Limited was £544,000, and made a loan of £100,000 of 8% debentures to Fred Limited on 1 January 2019.

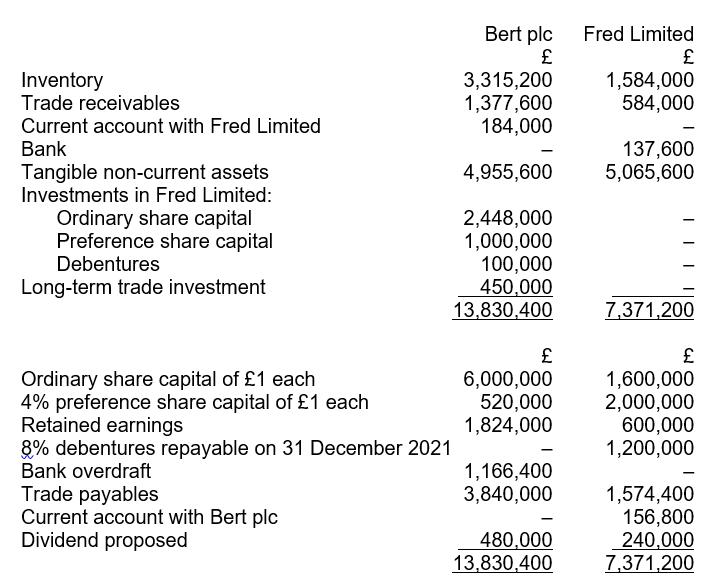

The unadjusted list of balances of Bert plc and Fred Limited at 31 December 2019 are shown below.

The following additional information is available.

(1) No interim dividends were declared or paid in the year 2019 out of year 2019 profits. Bert plc has not yet accounted for the dividends receivable from Fred Limited.

- The interest on the debentures of Fred Limited has not been paid for in the year ended 31 December 2019 and has not been included in the list of balances shown above.

(3) A remittance of £27,200 sent by Fred Limited in late December 2019 was not received by Bert plc until January 2020.

(4) Included in Fred Limited’s inventory at 31 December 2019 were goods that had been sold to them during the year by Bert plc for £64,000, which had an original cost of £38,400.

- The value of goodwill arising following the acquisition of the ordinary share capital of Fred Limited had become impaired in value by £349,200 up to 31 December 2019 and the value of goodwill arising following the acquisition of the preference share capital of Fred Limited had become impaired in value by £40,000 by the same date.

Required

Prepare the Consolidated Statement of Financial Position of the Bert Group plc at 31 December 2019. (100%)

Question 2100%

This question has five parts, (A) to (E). Answer all five parts.

Pennine Limited is a UK company that buys and sells furniture all over the world. The following information is available for the year ending 30 September 2020, when the €/£ exchange rate was €1.10 = £1.

- On 1 June 2020, Pennine Limited purchased chairs from an Italian manufacturer for €200,000 when the exchange rate was €1.11 = £1.00. The purchase contract specified that the payment for the chairs would be made on 30 October 2020 at a pre-specified exchange rate of €1.12 = £1.00. At 30 October 2020, the actual exchange rate was €1.09 = £1.00.

- On 29 June 2020, Pennine Limited purchased some desks from a German company for €10,000 when the exchange rate was €1.08 = £1.00. Pennine Limited paid for the equipment on 1 November 2020 when the exchange rate was €1.11 = £1.00.

- Pennine Limited regularly sells sofas to customers in France. On 31 July 2020, they sold sofas to a French company for €100,000 as a three month forward contract. The various €/£ exchange rates were:

Spot rate 3 month forward rate

31 July 2020 1.11 1.13

31 October 2020 1.14 1.15

- On 1 October 2016, Pennine Limited acquired shares in Mendip Inc., a US company that is also involved in the buying and selling of furniture. Pennine Limited paid $1,000,000 on 1 October 2016 to acquire the shares in Mendip Inc. The acquisition was financed partly by a long-term loan of SFr499,500 from a Swiss bank.

Pennine Limited wishes to offset exchange differences on the loan against exchange differences on the investment. The SFr/$/£ exchange rates from 1 October 2016 were:

SFr $ £

1 October 2016 1.16 1.36 1.00

30 September 2017 1.18 1.38 1.00

30 September 2018 1.40 1.50 1.00

30 September 2019 1.22 1.40 1.00

30 September 2020 1.20 1.20 1.00

REQUIRED

- State the objectives of foreign currency translation in financial accounting. Maximum 250 words.(16%)

- For item (1), page 14:

(i) Calculate the sterling value of the amount owed by Pennine Limited to the Italian company at 30 September 2020. (5%)

(ii) Calculate the sterling value of the amount paid by Pennine Limited to the Italian company on 30 October 2020. (2%)

(C) For item (2), page 14:

(i) Calculate the sterling value of the amount owed by Pennine Limited to the German company at 30 September 2020. (6%)

- Calculate the sterling value of the amount paid by Pennine Limited to the German company on 1 November 2020. (6%)

(D) For item (3), page 14, calculate the sterling value of the amount owed to Pennine Limited by the French company at 30 September 2020.

(E) For item (4), page 14:

- Calculate the carrying values of the investment and the loan in the statement of financial positon of Pennine Limited at the end of each of the financial years from 30 September 2017 to 30 September 2020. (16%)

- Show how the net exchange difference arising between the values of the investment and the loan should be dealt with in the financial statements of Pennine Limited for each of the financial years from 30 September 2017 to 30 September 2020. (36%)

- Show how the information regarding the exchange gains or losses on the loan for each of the financial years ending 30 September 2018 and 30 September 2019 should be disclosed in the notes to the financial statements of Pennine Limited to comply with IAS 21: The Effects of Changes in Foreign Exchange Rates. (8%)

Question 3100%

This question has three parts, (A) to (C). Answer all three parts.

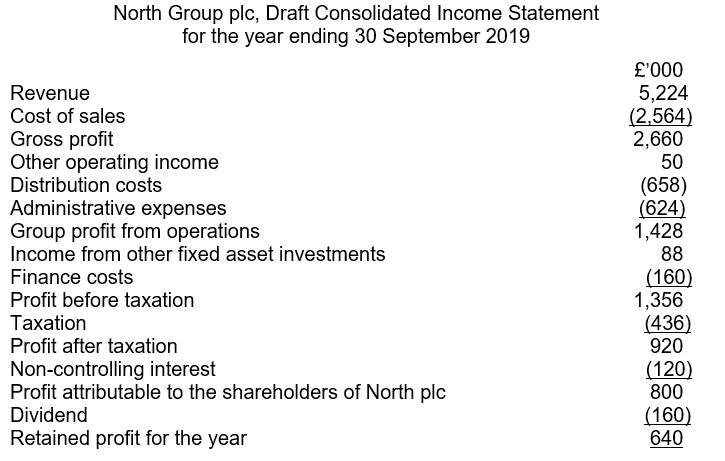

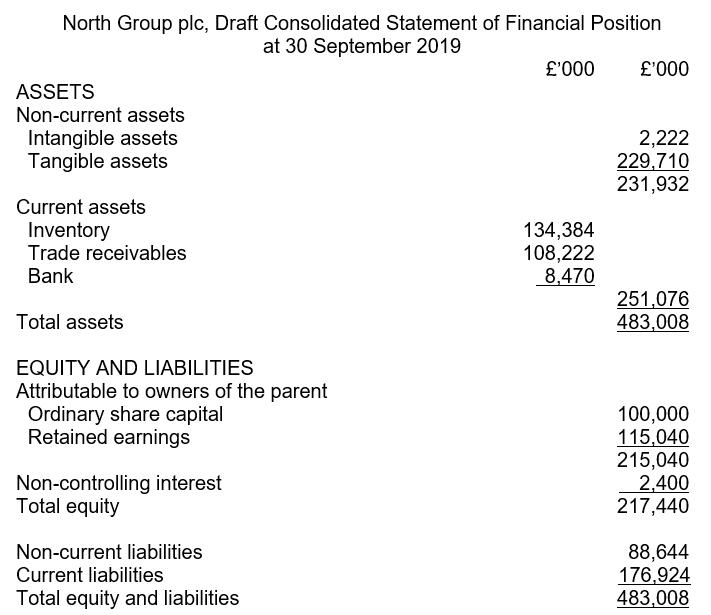

The following draft financial statements relate to the North Group plc.

The following additional information is available regarding the financial statements of the North Group plc.

- The group’s management structure is based around the manufacture and sale of clothes and toys. The total revenue of the group after the inclusion of intra-segment sales is divided in the ratio 1:3 between clothes and toys. The total intra-segment sales of the clothes part of the group are £176,000 and the total inter-segment sales are £1,096,000.

- Included within the profit before taxation are common costs of £248,000 that cannot be divided between the clothes and toys businesses. All of the finance costs relate to the toys part of the group. Of the profit before common costs, finance costs and taxation, a total of 88% relates to the toys part of the group.

- The total group assets, excluding unallocated assets, are £444,380,000, and, of these, total assets of £222,912,000 relate to clothing assets.

- The segment non-current assets for the clothes and toys parts of the group are £100,000,000 and £101,992,000 respectively.

- The total liabilities of the toys part of the group and the total segment liabilities are £170,000,000 and £240,000,000 respectively.

- Other costs incurred by the clothes part of the group and in total by the group are:

Clothes Total

£’000 £’000

Additions to non-current assets other than financial

instruments 20 36

Depreciation expense 40 92

Non-cash expenses other than depreciation or

amortisation 12 34

(7) The group manufactures and sells clothes and toys in the UK, Africa and the rest of Europe. The total sales made in the UK and Africa to third parties are £3,600,000 and £800,000 respectively.

REQUIRED

- Explain the purpose of disclosing segmental information in accounts. Maximum 300 words.(18%)

- Using the information on pages 23-25, prepare the operating segments note of the group financial statements of the North Group plc for the year ended 30 September 2019. You should work to the nearest £’000. (64%)

- Discuss the limitations of disclosing segmental information, and when possible, you should use the “segmental analysis” note prepared in part (B), above, to illustrate your arguments. Maximum 300 words.(18%)

Question 4100%

Bert plc acquired 75% of the ordinary share capital of Fred Limited on 1 January 2018, when the balance on the retained earnings reserve of Fred Limited was £500,000. Bert plc also acquired 40% of the preference share capital of Fred Limited on 1 January 2019, when the balance on the retained earnings reserve of Fred Limited was £544,000, and made a loan of £100,000 of 8% debentures to Fred Limited on 1 January 2019.

The unadjusted list of balances of Bert plc and Fred Limited at 31 December 2019 are shown below.

The following additional information is available.

(1) No interim dividends were declared or paid in the year 2019 out of year 2019 profits. Bert plc has not yet accounted for the dividends receivable from Fred Limited.

- The interest on the debentures of Fred Limited has not been paid for in the year ended 31 December 2019 and has not been included in the list of balances shown above.

(3) A remittance of £27,200 sent by Fred Limited in late December 2019 was not received by Bert plc until January 2020.

(4) Included in Fred Limited’s inventory at 31 December 2019 were goods that had been sold to them during the year by Bert plc for £64,000, which had an original cost of £38,400.

- The value of goodwill arising following the acquisition of the ordinary share capital of Fred Limited had become impaired in value by £349,200 up to 31 December 2019 and the value of goodwill arising following the acquisition of the preference share capital of Fred Limited had become impaired in value by £40,000 by the same date.

Required

Prepare the Consolidated Statement of Financial Position of the Bert Group plc at 31 December 2019. (100%)

Question 5 100%

This question has two parts, (A) and (B). Answer both parts.

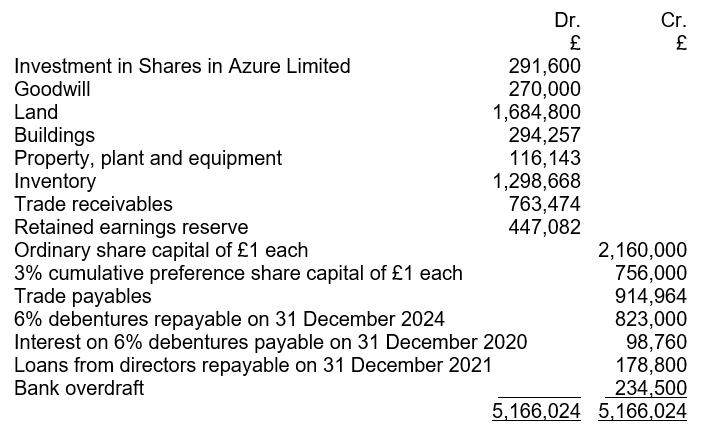

The following balances have been extracted from Teal Limited’s accounting records at 31 December 2020.

Azure Limited has made losses for several years. The company suffered a further downturn in trade during the unsettled trading environment between March and December 2020. The shareholders and directors of Teal Limited have now decided to carry out a scheme of internal reconstruction prior to changing the company’s strategy. The following scheme has been agreed.

- The investment in shares in Azure Limited is to be written down to £226,800.

- The goodwill and retained earnings balances are to be written off.

- The following assets have been valued professionally at the following amounts:

£

Land 1,700,000

Buildings 500,000

Property, plant and equipment 96,000

Inventory 250,000

- A provision for bad debts of 3% of the value of the trade receivables is to be made.

- The trade payables are to be paid £497,000 immediately and the balance is to be repaid by 31 December 2021.

- Each ordinary share is to be redesignated as a share of 50p each.

- The ordinary shareholders that existed prior to the reconstruction scheme are to subscribe for a new issue of ordinary shares with a nominal value of 50p each. The issue is on the basis of a 1 for 2 share issue at an issue price of 65p per share.

- Of the directors’ loans, £28,800 is to be cancelled. The balance is to be settled by the issue of 187,500 ordinary shares of 50p each, at an issue price of 80p per share.

- The existing 3% cumulative preference shares of £1 each are to be exchanged for a new issue of 378,000 4% non-cumulative preference shares of £1 each and 756,000 ordinary shares of 50p each.

- The 6% debenture holders are to accept 160,000 ordinary shares of 50p each instead of payment of the interest payable on the debentures. The interest rate on the debentures is to be increased to 7%. A further £100,000 7% debentures are to be issued.

REQUIRED

- Prepare the journal entries to implement the reconstruction scheme. You should provide a narrative explanation of each journal entry. (50%)

- The reconstruction scheme has effects for the various stakeholders of Teal Limited. Explain the impact of the scheme upon each of the following stakeholders:

- Bank.

You should show the revised bank balance after the above transactions (pages 43-44) have been implemented.

- Debenture holders

- Trade payables

- Original ordinary shareholders,

- Original preference shareholders Maximum 650 words, excluding calculations.

(50%)

Revenue Cost of sales Other operating income Distribution costs Administrative expenses Investment income Taxation Dividends Retained earnings at 1 April 2019 Retained earnings at 31 March 2020 Liverpool plc 9,600,000 (5,000,000) Manchester Ltd (980,000) 260,000 4,752,000 (2,200,000) Sheffield Ltd 620,000 (720,000) (450,000) (24,000) (380,000) (60,000) (750,000) (410,000) (600,000) (300,000) 8,000,000 920,000 10,430,000 1,932,000 500,000 (340,000) (12,000) (8,000) 30,000 86,000 Inventory Trade receivables Current account with Fred Limited Bank Tangible non-current assets Investments in Fred Limited: Ordinary share capital Preference share capital Debentures Long-term trade investment Ordinary share capital of 1 each 4% preference share capital of 1 each Retained earnings 8% debentures repayable on 31 December 2021 Bank overdraft Trade payables Current account with Bert plc Dividend proposed Bert plc 3,315,200 1,377,600 184,000 4,955,600 2,448,000 1,000,000 100,000 450,000 13,830,400 6,000,000 520,000 1,824,000 1,166,400 3,840,000 480,000 13,830,400 Fred Limited 1,584,000 584,000 137,600 5,065,600 7,371,200 1,600,000 2,000,000 600,000 1,200,000 1,574,400 156,800 240,000 7,371,200 North Group plc, Draft Consolidated Income Statement for the year ending 30 September 2019 Revenue Cost of sales Gross profit Other operating income Distribution costs Administrative expenses Group profit from operations Income from other fixed asset investments Finance costs Profit before taxation Taxation Profit after taxation Non-controlling interest Profit attributable to the shareholders of North plc Dividend Retained profit for the year 000 5,224 (2,564) 2,660 50 (658) (624) 1,428 88 (160) 1,356 (436) 920 (120) 800 (160) 640 North Group plc, Draft Consolidated Statement of Financial Position at 30 September 2019 ASSETS Non-current assets Intangible assets Tangible assets Current assets Inventory Trade receivables Bank Total assets EQUITY AND LIABILITIES Attributable to owners of the parent Ordinary share capital Retained earnings Non-controlling interest Total equity Non-current liabilities Current liabilities Total equity and liabilities 000 134,384 108,222 8,470 000 2,222 229,710 231,932 251,076 483,008 100,000 115,040 215,040 2,400 217,440 88,644 176,924 483,008 Inventory Trade receivables Current account with Fred Limited Bank Tangible non-current assets Investments in Fred Limited: Ordinary share capital Preference share capital Debentures Long-term trade investment Ordinary share capital of 1 each 4% preference share capital of 1 each Retained earnings 8% debentures repayable on 31 December 2021 Bank overdraft Trade payables Current account with Bert plc Dividend proposed Bert plc 3,315,200 1,377,600 184,000 4,955,600 2,448,000 1,000,000 100,000 450,000 13,830,400 6,000,000 520,000 1,824,000 1,166,400 3,840,000 480,000 13,830,400 Fred Limited 1,584,000 584,000 137,600 5,065,600 7,371,200 1,600,000 2,000,000 600,000 1,200,000 1,574,400 156,800 240,000 7,371,200 Investment in Shares in Azure Limited Goodwill Land Buildings Property, plant and equipment Inventory Trade receivables Dr. 291,600 270,000 1,684,800 294,257 116,143 1,298,668 763,474 447,082 Retained earnings reserve Ordinary share capital of 1 each 3% cumulative preference share capital of 1 each Trade payables 6% debentures repayable on 31 December 2024 Interest on 6% debentures payable on 31 December 2020 Loans from directors repayable on 31 December 2021 Bank overdraft 5,166,024 Cr. 2,160,000 756,000 914,964 823,000 98,760 178,800 234,500 5,166,024

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Q1 A BroadcastingisthelargestsourceofrevenueforLiverpoolFCIn20182019theclubearnedapproximately2993millioneurosfrombroadcastingmorethantriplethanin20102011Thesecondbiggestrevenuestreamisthecommercialon... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

62847aee42422_79102.docx

120 KBs Word File