Anna has given Sam the following management accounting information. She has estimated that Smart Sports total manufacturing

Question:

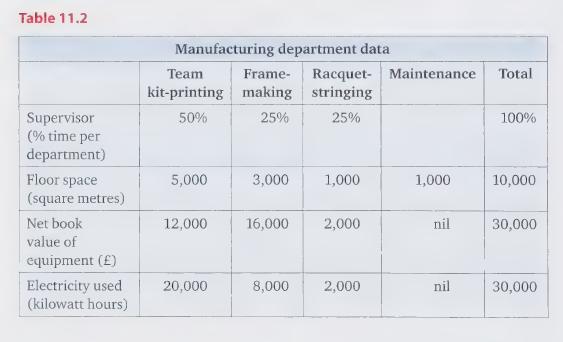

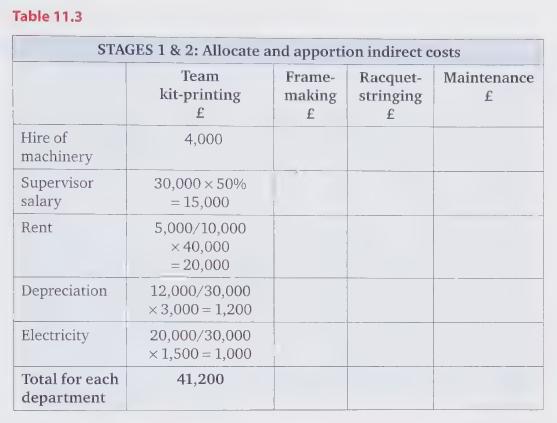

Anna has given Sam the following management accounting information. She has estimated that Smart Sports’ total manufacturing costs for 2018 will include the hire of machinery: £4,000 for the printing machine and £6,600 for the frame machine. She expects to be paid £30,000. There will also be the factory rent of £40,000, depreciation of £3,000, and electricity costs of £1,500. She has also given Sam the data shown in table 11.2 for his manufacturing departments.

Required:

a) Allocate and apportion these estimated costs to calculate a total estimated cost for the year for each of Smart Sports’ manufacturing departments.

Complete Table 11.3. The solution for team kit-printing has been given as an example.

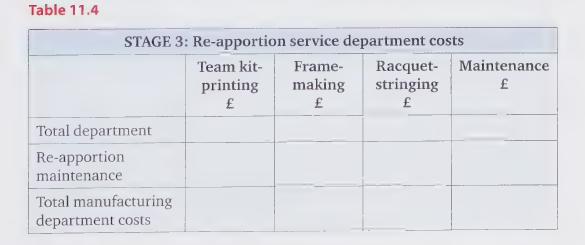

b) Re-apportion the maintenance department’s costs over the kit-printing and frame-making departments, assuming that the maintenance staff spend 3,000 hours in kit-printing and 2,000 hours in frame-making. Complete Table 11.4.

Each manufacturing department now has a total budgeted overhead cost from which a departmental rate can be calculated.

Step by Step Answer:

Accounting A Smart Approach

ISBN: 9780199587414

1st Edition

Authors: Mary Carey, Jane Towers Clark, Cathy Knowles