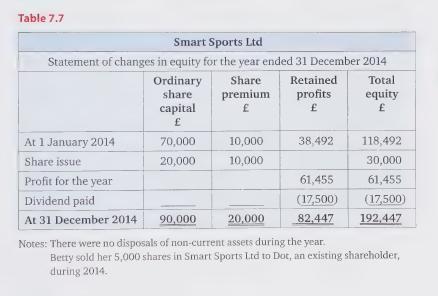

In January 2014, Raja invested 30,000 in Smart Sports Ltd by buying 20,000 shares in the business.

Question:

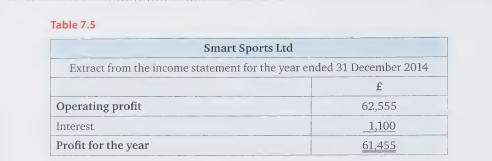

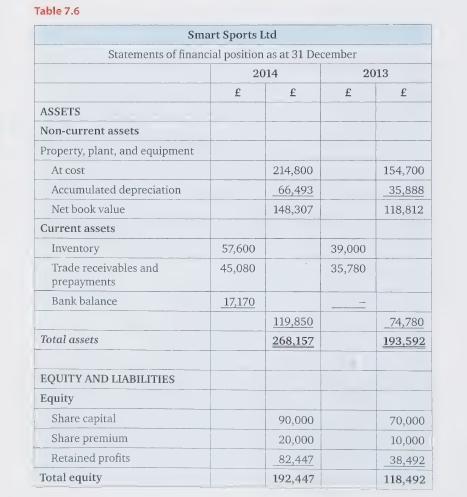

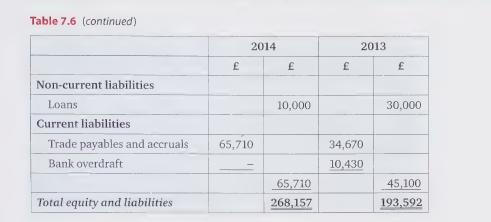

In January 2014, Raja invested £30,000 in Smart Sports Ltd by buying 20,000 shares in the business. In the same month, he set-up shops in Mumbai and Delhi and started trading, having appointed managers at each branch. The company results, including the Indian branches, show a profit for that year of £61,455 on which no tax was payable. Extracts from the financial statements are given in Tables 7.5, 7.6, and 7.7.

Required:

a) In preparing the statement of cash flows, explain how the issue of new shares to Raja should be accounted for.

b) Describe the effect of Betty selling her shares to Dot on the statement of cash flows.

c) Using the financial statements in Tables 7.5, 7.6, and 7.7, prepare the statement of cash flows for Smart Sports Ltd for the year ended 31 December 2014.

Step by Step Answer:

Accounting A Smart Approach

ISBN: 9780199587414

1st Edition

Authors: Mary Carey, Jane Towers Clark, Cathy Knowles