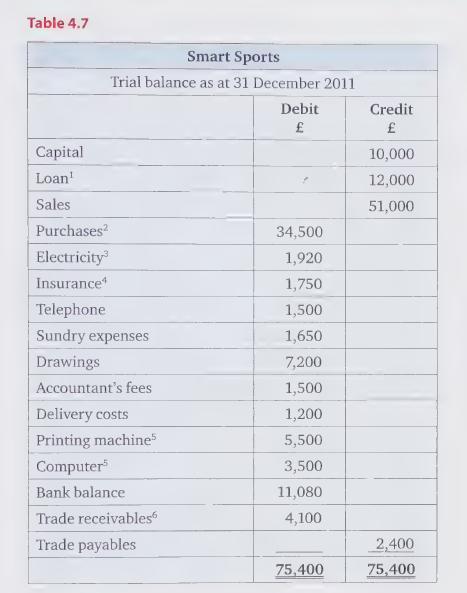

The trial balance for Smart Sports is given in Table 4.7, along with additional information in the

Question:

The trial balance for Smart Sports is given in Table 4.7, along with additional information in the table footnotes that will enable the final version of the income statement and statement of financial position to be prepared.

1. The loan was interest-free for the first six months of the year, after which time interest was to be paid at the rate of 6% per annum.

No interest was paid during the year.

2. Inventory held at the year-end was valued at £2,700.

3. Electricity used but not yet paid for as at the year-end amounted to £480.

4. Insurance had been prepaid by £351 at the year-end.

5.Depreciation is to be charged on non-current assets as follows:

Printing machine: 25% per annum on the straight-line basis.

Computer: 40% per annum on the reducing-balance basis.

6.Abad debt of £820 is also to be written off at the year-end.

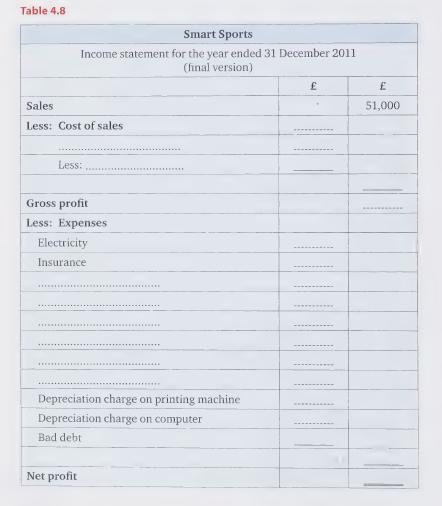

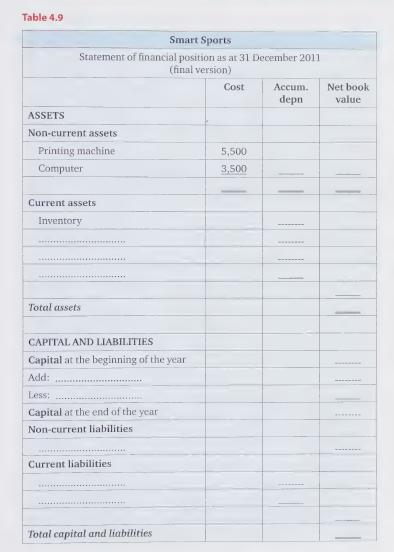

Using the partially completed financial statements to guide you, prepare the income statement for Smart Sports as at 31 December 2011 (Table 4.8) and the statement of financial position (Table 4.9) as at that date.

Step by Step Answer:

Accounting A Smart Approach

ISBN: 9780199587414

1st Edition

Authors: Mary Carey, Jane Towers Clark, Cathy Knowles