Amazon.com, Inc .'s financial statements are presented in Appendix D. Financial statements of Walmart Inc. are presented

Question:

Amazon.com, Inc .'s financial statements are presented in Appendix D.

Financial statements of Walmart Inc. are presented in Appendix E.

The complete annual reports of Amazon and Walmart, including the notes to the financial statements, are available at each company's respective website.

Instructions

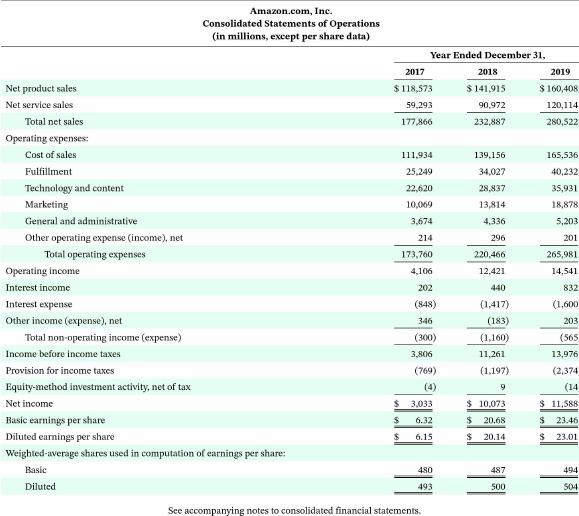

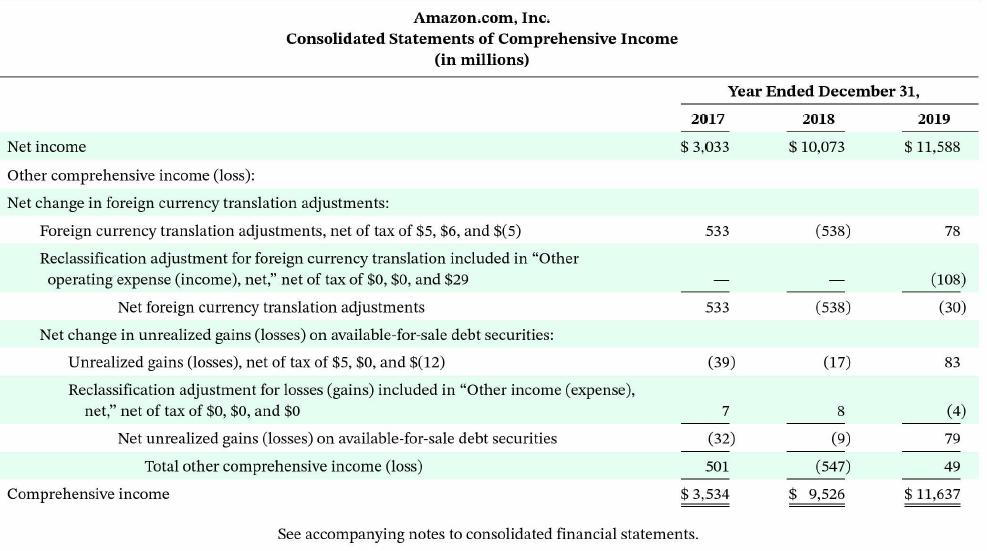

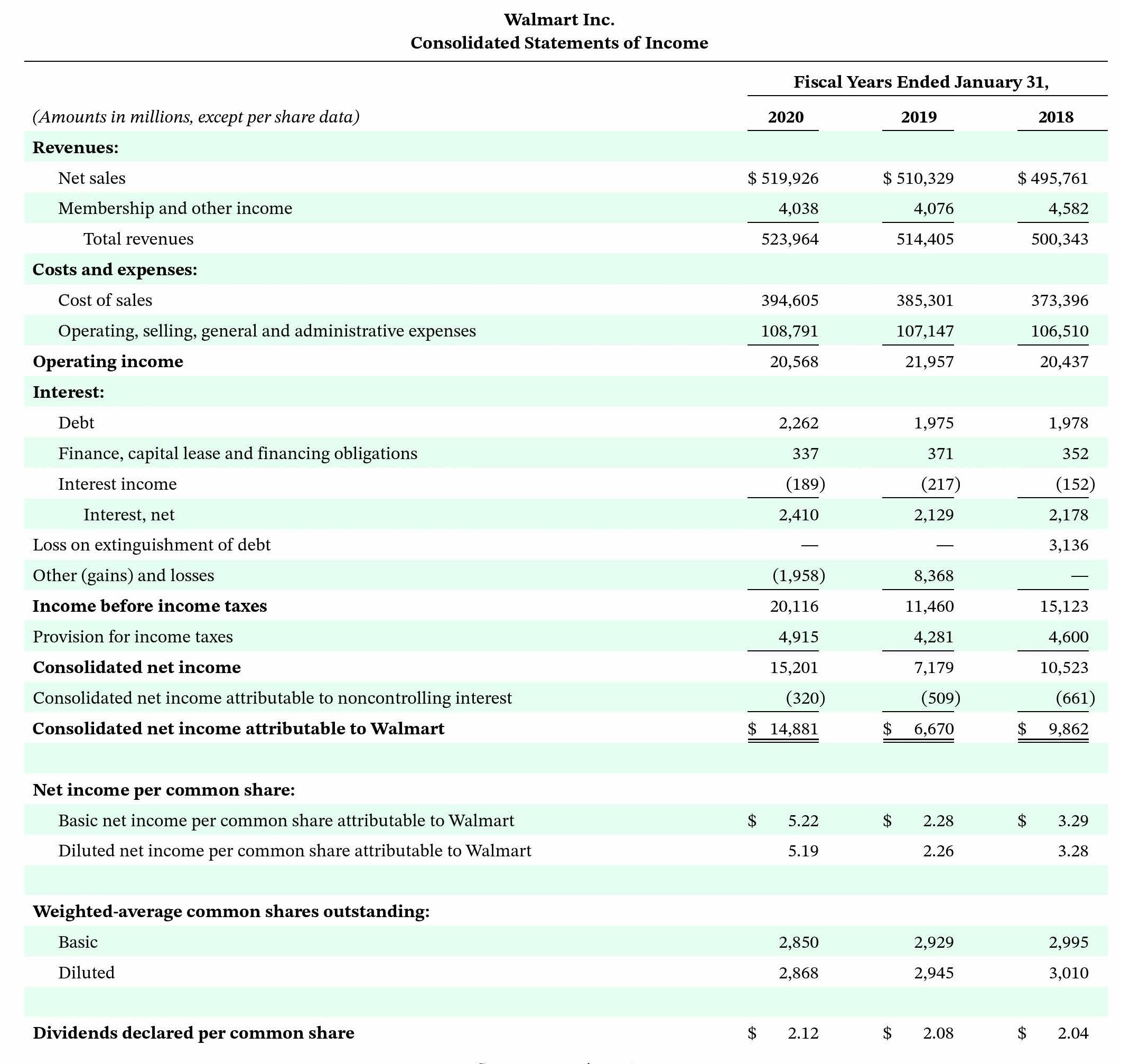

a. Based on the information contained in these financial statements, compute the following 2019 ratios for Amazon and 2020 ratios for Walmart.

1. Debt to assets.

2. Times interest earned.

b. What conclusions concerning the companies' long-run solvency can be drawn from these ratios?

Transcribed Image Text:

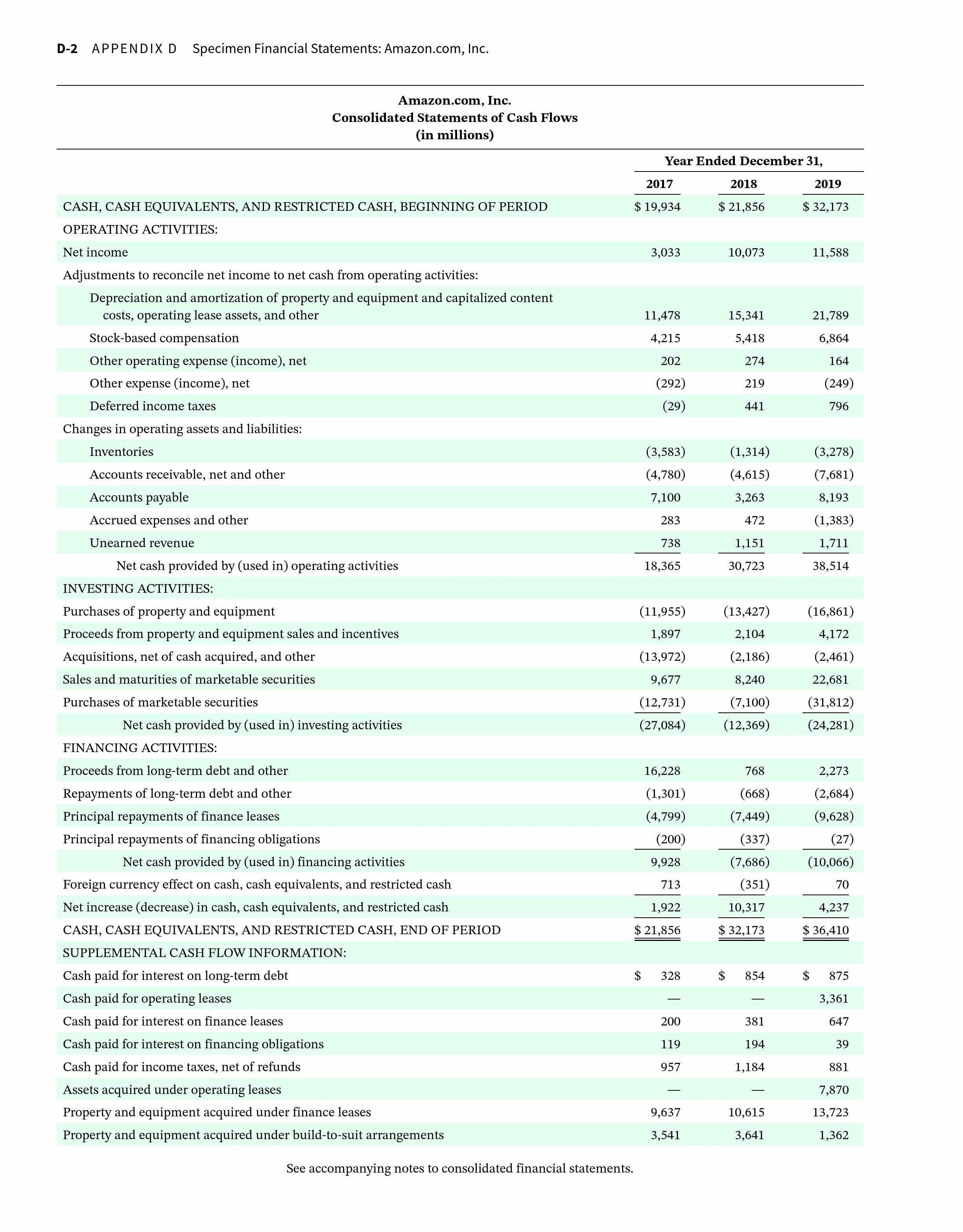

D-2 APPENDIX D Specimen Financial Statements: Amazon.com, Inc. CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash from operating activities: Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other Stock-based compensation Other operating expense (income), net Other expense (income), net Deferred income taxes Changes in operating assets and liabilities: Inventories Amazon.com, Inc. Consolidated Statements of Cash Flows (in millions) Accounts receivable, net and other Accounts payable Accrued expenses and other Unearned revenue Net cash provided by (used in) operating activities INVESTING ACTIVITIES: Purchases of property and equipment Proceeds from property and equipment sales and incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES: Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of finance leases Principal repayments of financing obligations Net cash provided by (used in) financing activities Foreign currency effect on cash, cash equivalents, and restricted cash Net increase (decrease) in cash, cash equivalents, and restricted cash CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt Cash paid for operating leases Cash paid for interest on finance leases Cash paid for interest on financing obligations Cash paid for income taxes, net of refunds Assets acquired under operating leases Property and equipment acquired under finance leases Property and equipment acquired under build-to-suit arrangements See accompanying notes to consolidated financial statements. Year Ended December 31, 2017 $ 19,934 3,033 $ 11,478 4,215 202 (292) (29) (3,583) (4,780) 7,100 283 738 18,365 (11,955) 1,897 (13,972) 9,677 (12,731) (27,084) 16,228 (1,301) (4,799) (200) 9,928 713 1,922 $21,856 328 200 119 957 9,637 3,541 2018 $ 21,856 10,073 15,341 5,418 274 219 441 (1,314) (4,615) 3,263 472 1,151 30,723 (13,427) 2,104 (2,186) 8,240 (7,100) (12,369) 768 (668) (7,449) (337) (7,686) (351) 10,317 $ 32,173 854 381 194 1,184 10,615 3,641 2019 $ 32,173 11,588 21,789 6,864 164 (249) 796 $ (3,278) (7,681) 8,193 (1,383) 1,711 38,514 (16,861) 4,172 (2,461) 22,681 (31,812) (24,281) 2,273 (2,684) (9,628) (27) (10,066) 70 4,237 $36,410 875 3,361 647 39 881 7,870 13,723 1,362

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

a Amazon Walmart 1 Debt to assets 163188 724 225248 154943 236495 655 2 Times interest earned 11588 ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 9781119707110

14th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Jill E. Mitchell

Question Posted:

Students also viewed these Business questions

-

Amazon.com, Inc. vs. Walmart Inc. CTll.3 Amazon.com Inc.'s financial statements are presented in Appendix D. Financial statements of Walmart Inc. are presented in Appendix E. The complete annual...

-

Amazon.com, Inc.'s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. Instructions for accessing and using the complete...

-

PepsiCos financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. Instructions for accessing and using the complete annual reports...

-

How to drive target audience or people of Cineplex to movie theaters? Come up with a campaigns with big idea about Cineplex

-

How do depository institutions balance risk and return?

-

Given Y²(t) = AY(t) Y(0) = Y0 where compute etA and use it to solve the initial value problem. 3 2 3 4 12l)

-

Transferred-in costs, FIFO costing (continuation of 17-33). Required Using the FIFO process-costing method, do the requirements ofProblem 17-33. The transferredin costs from the Assembly Department...

-

We are given the following information for the Pettit Corporation. Sales (credit)$3,549,000 Cash179,000 Inventory911,000 Current liabilities788,000 Asset turnover1.40 times Current ratio2.95 times...

-

Today your company paid a dividend of $2 per share. The growth rate of the dividend is expected to be constant at 10% per year. The required return is 15%. What is your firms stock currently worth?...

-

Explain the difference between a required RFC and a recommended RFC.

-

The joint projects of the FASB and IASB could potentially: a . Change the definition of liabilities. b . Change the definition of equity. c . Change the definition of assets. d . All of the answers...

-

The following section is taken from Mareska's balance sheet at December 31, 2021. Interest is payable annually on January 1. The bonds are callable on any annual interest date. Instructions. a ....

-

Which of the following statements best describes how Lincoln felt the rest of the country was responding to the expansion of slavery? F. Lincoln believed that most Southerners wanted to limit slavery...

-

Use the following information for questions 1 and 2. Caterpillar Financial Services Corp. (a subsidiary of Caterpillar) and Sterling Construction sign a lease agreement dated January 1, 2020, that...

-

Identifying Binomial Distributions. Determine whether the given procedure results in a binomial distribution or a distribution that can be treated as binomial (by applying the 5% guideline for...

-

Case 6: TOMS Shoes in 2016: An Ongoing Dedication to Social Responsibility, by Margaret A. Peteraf, Sean Zhand, and Meghan L. Cooney (page C-57) Read the case and then respond to the case questions...

-

Quatro Co. issues bonds dated January 1, 2019, with a par value of $740,000. The bonds' annual contract rate is 13%, and interest is paid semiannually on June 30 and December 31. The bonds mature in...

-

Wildcat Mining wants to know the appropriate discount rate to use in their capital budgeting decision making process. Based on the following data, what is the weighted average cost of capital the CFO...

-

Compute the indefinite integral of the following functions. 2t t j Vt? + 4 r(t) = te' i + t sin

-

Q1) What is the a3 Value Q2) What is the a7 Value Q3) What is the a4 Value Q4) What is the b3 Value Q5) What is the b2 Value Q6) What is the sign of 2nd constraint? A pastry chef at a bakery wants to...

-

PepsiCos financial statements are presented in Appendix A. Financial statements of The Coca-Cola Company are presented in Appendix B. Instructions (a) Based on the information contained in these...

-

PepsiCos financial statements are presented in Appendix A. Financial statements of The Coca-Cola Company are presented in Appendix B. Instructions (a) Based on the information contained in these...

-

PepsiCos financial statements are presented in Appendix A. Financial statements of The Coca-Cola Company are presented in Appendix B. Instructions (a) Based on the information contained in these...

-

Current Portion of Long-Term Debt PepsiCo, Inc., reported the following information about its long-term debt in the notes to a recent financial statement (in millions): Long-term debt is composed of...

-

Show transcribed image text 31/12/2016 GHS'000 25,500 The following information relates to the draft financial statements of Samanpa Ltd. Summarised statement of financial position as at: 31/12/2017...

-

\ How do i solve this? Beginning raw materials inventory Ending raw materials inventory Direct labor Operating expenses Purchases of direct materials Beginning work in process inventory Ending work...

Study smarter with the SolutionInn App